In a pivotal session at the Invest in African Energy forum held in Paris, high-level officials from the Organization of the Petroleum Exporting Countries (OPEC) provided an in-depth analysis of the crude oil market’s future, focusing on short- to long-term perspectives.

The session drew from OPEC’s latest Monthly Oil Market Report and World Oil Outlook, shedding light on the key drivers of oil supply and demand up to 2045 and the crucial role of African and emerging markets.

The panel identified robust growth drivers for both oil supply and demand over the next few decades, highlighting the significant contribution of emerging markets, including those in Africa. These regions are expected to lead global economic expansion and energy consumption, driven by increasing industrialization and urbanization.

“We believe in the future of Africa and the South-South – we see almost all of global oil demand coming out of emerging markets. We see the global economy at least doubling in size and emerging nations commanding the lion’s share of energy demand going forward. Africa sits north of 120 billion barrels of crude, which can be extended to all commodities – precious metals, gas, hydropower, and all of the above. The issue of investment is significant and hinders the exploitation of these resources that could facilitate huge potential for economic growth.”

r. Ayed Al-Qahtani, Director of Research Division and OPEC

Irene Nkem Etiobhio, Chief Petroleum Industry Analyst, discussed the medium-term outlook, pointing to a significant increase in non-OPEC oil supply. “We’re looking at an addition of 7 million barrels of oil per day from Brazil, Guyana, and Canada. However, we expect this supply to peak towards the 2030s.” Post-peak, the demand for OPEC supply is projected to rise, capturing about 40% of the market by 2045.

The panel also addressed broader economic trends affecting the oil market. Behrooz Baikalizadeh, Head of the Petroleum Studies Department, projected global economic growth of 2.8% in 2024 and 2.9% in 2025, with a gradual decline in inflation reducing the need for stringent monetary policies. Angel Edjang Memba, Senior Financial Analyst, noted the US economy’s expected growth at 2.2% in 2024 and 1.9% in 2025, foreseeing continued inflationary pressures and high commodity prices due to the robust economic performance.

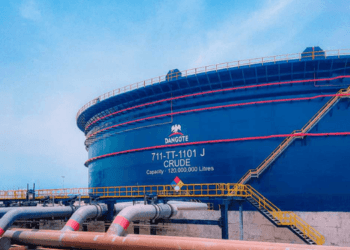

Tona Ndamba, Chief Refinery & Products Analyst, highlighted significant developments in African refining capacity, particularly the impact of new large-scale refineries like Nigeria’s 650,000 barrels per day Dangote refinery. These advancements are set to reshape the sector, increasing the supply of refined petroleum products and potentially lowering wholesale prices, though initial pressures on refining margins are expected.

Impact on Africa’s Refining Sector

The insights shared at the forum underscore Africa’s pivotal role in the global energy landscape. The continent’s substantial crude oil reserves and emerging refining capacity signal a potential shift towards greater self-sufficiency and economic growth. However, achieving this potential hinges on overcoming investment hurdles and addressing geopolitical and economic challenges.

As Africa’s energy sector evolves, the continent is positioned not only to meet its energy needs but also to play a critical role in global oil markets. The discussions at the Invest in African Energy forum highlight a future where Africa’s natural resources drive significant economic activity and growth, benefiting both the region and the global economy.

“There have been notable changes in global refining capacity with new large-scale refineries coming online … These have contributed to a rise in new product supplies. In the near-term, this will exhibit pressure on refining margins, but could also be a good sign for end consumers, where wholesale prices are going down with more supply,” said Tona Ndamba, Chief Refinery & Products Analyst.

The session at the Invest in African Energy forum underscored the strategic importance of Africa within the global oil market, highlighting opportunities for growth and the challenges that need to be addressed to unlock the continent’s full potential. By leveraging its abundant natural resources and fostering partnerships for investment and technology transfer, Africa stands poised to play a crucial role in meeting the world’s evolving energy needs.

READ ALSO: NDC Challenges EC’s Claim on BVR Machine Serial Numbers