A series of attacks on commercial ships in the Red Sea by Houthi rebels in Yemen has ignited fears of a ripple effect on global oil prices and the intricate web of the supply chain.

As shipping companies adjust their routes and an international naval operation is launched to secure the Red Sea route, the situation unfolds as a critical geopolitical challenge with potential far-reaching economic consequences.

The aftermath of the attacks has prompted significant alterations in shipping routes, with Maersk, the world’s second-largest shipping line, diverting vessels around Africa’s Cape of Good Hope.

This decision, driven by heightened risks in the Red Sea, not only disrupts shipping schedules but also incurs substantial additional costs. Other major shipping companies are grappling with the decision to reroute, balancing safety concerns against the economic impact.

In response to the escalating security threats in the Red Sea, the United States has spearheaded an international naval operation named Operation Prosperity Guardian. Countries such as the UK, Canada, France, Bahrain, Norway, and Spain have joined forces in an attempt to safeguard the vital Red Sea route and ensure the unimpeded flow of global trade.

Despite the international response, Houthi rebels remain steadfast in their commitment to continue attacks in the Bab al-Mandeb strait—a crucial shipping lane connecting Asia and Europe. Senior Houthi official Mohammed al-Bukhaiti underscored their determination to persist with military operations, regardless of the sacrifices involved.

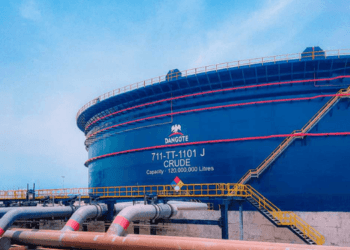

The Red Sea serves as a linchpin for oil and liquefied natural gas shipments, adding another layer of complexity to the situation. Major oil players, including BP, have temporarily halted crude shipments through the affected route, raising concerns about potential disruptions in the global energy supply chain. While oil prices experienced a modest 1% increase on Monday, the full impact on this critical sector remains uncertain.

Challenges for Shipping Companies

Shipping firms directly affected by the attacks, such as Hapag-Lloyd, are demanding absolute assurances of safety before resuming operations through the Red Sea. Rerouting ships not only entails increased fuel and insurance costs but also poses the risk of congestion at ports and further delays in the intricate global supply chain.

The Red Sea accounts for approximately 12% of global trade, representing a staggering $1 trillion worth of goods annually. Rerouting measures adopted by major container carriers are poised to have profound implications for the global supply chain, extending beyond the realm of oil to impact industries worldwide.

While the immediate impact on oil prices has been relatively contained, the situation is being closely monitored by industry experts. Geopolitical tensions in the region add an element of uncertainty to the energy market, with the potential for a more pronounced rise in oil prices looming on the horizon.

As the international community rallies to secure the Red Sea route and protect essential trade interests, the unfolding scenario highlights the vulnerability of global supply chains to geopolitical unrest. The ongoing efforts to navigate these challenges underscore the interconnected nature of the global trade network, emphasizing the need for diplomatic solutions to ensure stability in key maritime routes.

The situation remains fluid, with economic stakeholders worldwide watching closely as events continue to unfold in this critical region.

READ ALSO: NPP Opens Nominations For Parliamentary Primaries Today