Mr. George Ankomah, the Lead Tax & Regulatory Partner at the Deloitte- Ghana, has disclosed that passing numerous taxes will not guarantee the country a green light for the $3 billion International Monetary Fund (IMF) cash.

This comes on the back of Parliament, through a Majority decision, passed three new taxes on March 31, 2023 – which is to generate approximately GH¢4 billion per year to supplement domestic revenue. These are Income Tax Amendment Bill, Excise Duty Amendment Bill, and Growth and Sustainability Amendment Bill.

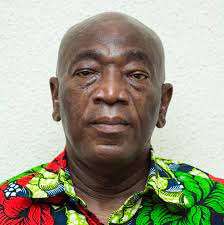

Speaking during an interview, Mr. Ankoma indicated that the government will have to put in more efforts on reviving the economy rather than the passage of new taxes.

The lead tax expert emphasized that there are underlying factors the government must meet and demonstrate in order to get the approval of the IMF deal, “and not the passage of tax laws,” he said.

“We have not put forth a hundred percent all pertaining to what the IMF is asking for, and what we need to do to have an IMF deal. The discussion around the debt exchange was very topical. After signing, we thought that was it and we were on course. Nonetheless, it happened that there is something more that needs to be done and so that is where we are in terms of the taxes.

“We were told that once these taxes are passed then we will be able to secure an IMF deal. The IMF to the best of my understanding is not necessarily asking for a tax bill to be passed, but the government rather demonstrates plans of how it is going to recover from the state in which we are.”

Mr. George Ankomah

Mr. Ankomah further added that: “In terms of sustainable economic growth and macroeconomic stability, Government is supposed to demonstrate how the country is going to achieve that.”

“So the government is of the view that some of these taxes that have been introduced should be one of the considerations for the IMF to see that we have made an effort to rake in more revenue as far as Ghana is concerned – to meet their requirement as a condition.”

Mr. George Ankomah

Passage Of New Taxes Will Result In Job Layoffs And Tougher Times

More so, the Trades Union Congress (TUC) has also expressed concerns about the passage of the three new revenue taxes

According to TUC’s Deputy Secretary-General, Joshua Ansah, many of the new taxes will be passed on to consumers.

Joshua Ansah, who spoke to journalists in Accra said the new taxes will impoverish ordinary Ghanaians and lead to massive job cuts.

“The increase in taxes has its own positives and negatives. The negative effect of the taxes is that manufacturers and companies who produce locally are to reduce employment when the tax burden is too much. Employers are going to lay off workers if they are unable to meet their income as against their expenditure.”

Joshua Ansah

In addition, some groups in the business community in the country have also expressed disappointment with Parliament’s approval of the government’s three new revenue tax bills.

Reacting to the passage of the bills, the spokesperson for the Food and Beverages Association of Ghana (FABAG), John Awuni, said it is disappointing that Ghana’s lawmakers disregarded the cry and agitations of the people and went ahead to have the bills approved.

“We feel very disappointed that the three tax bills were passed by the Parliament of Ghana, especially supported by the NPP MPs when no one was consulted on the new bills. We are disappointed in this action and the MPs must realise that they are representing the people of Ghana and not themselves.”

John Awuni

Mr. Awuni also lamented the absolute disregard of the Association’s petition against the passage of the bills which he said a simple dialogue could have prevented the passage of the unfriendly policies.

Read also: 600 Business to Begin the e-VAT System After Engagement- Commissioner of Domestic Tax