The country’s external debt service payments have doubled in just three years. The external service payment comprises the principal repayments as well as interest and other charges. Available information from the finance ministry shows that Ghana’s external debt service payment has increased by 100.5 percent between 2017 and 2020.

More specifically, Ghana’s external debt service payment rose from GH₵7.31 billion in 2017 to GH₵14.66 billion in 2020. This suggests that debt service payments are up by GH₵7.35 billion over 3 years. Cumulatively, the government spent GH₵28.04billion on the repayments of principal, thus, the nominal value of the government’s borrowings. On the other hand, interest payments and other charges amounted to GH₵16.6 billion.

External Debt Service

The country’s external service obligations have been growing steadily in consonants with the rise in the government’s gross public debt stock. In 2017, the government spent a total of GH₵7.31 billion to settle its external debts. This was made up of principal repayment of GH₵4.83 billion as well as the payment of interest and other charges to the tune of GH₵2.48 billion. Similarly, in 2018, the government spent a total of GH₵11.25 billion to honor its external debt service obligations. This comprised Interest payments & Charges of GH₵3.56 billion and a principal of GH₵7.69 billion.

Moreover, in 2019, external debt service payments rose marginally to GH₵11.53 billion. The government spent GH₵6.95 billion to repay the principal of loans and GH₵4.58 billion as Interest payments & Charges. Nevertheless, the government’s external debt service increased significantly in 2020.

“Total external debt service payments for 2020 was GH₵14.66 billion. This comprises principal repayments of GH₵8.57 billion and interest payment and other charges of GH₵5.97 billion. The total debt service shows an increase of 26.2 percent compared to 2019”.

Review of External Debt Portfolio

Meanwhile, the country’s debt service payment trajectory perfectly mirrors recent developments in its stock of external debt. The stock of external debt at the end of December 2020 stood at GH₵141.8 billion. This, according to the finance ministry, represents 37.0 percent of GDP and an increase of 25.8 percent compared to 2019.

“However, from 2017 to 2020, the size of the external debt relative to the public debt portfolio has declined from 55.5% to 48.6%”.

Also, the ministry of finance stated that its creditor classification shows that the share of commercial debt to the external debt portfolio has increased significantly over the period. The finance ministry attributed this increment to a rise in Eurobonds.

“The share of commercial debt increased from 36.8 percent in 2017 to 51.1 percent by 2020. The share of multilateral debt however declined from 37.2% in 2017 to 33.5% by 2020”.

Meanwhile, the finance ministry has revealed that in 2020, the government signed 26 new loans with a total commitment value of US$1.84 billion. This, the ministry clarified, was in addition to a US$3 billion Eurobond issued in February 2020.

External Debt Disbursement

In its 2020-End-Year-Bulletin, the finance ministry stated that the total disbursements for 2020 were GH₵23.96 billion. This, according to the ministry, is higher than GH₵20.83 billion disbursed in 2019.

The finance ministry attributed the increase in disbursements in 2020 to funding received from the IMF and World Bank in support of the CAP.

“From 2017 to 2020, disbursements have increased significantly due to the increase in Eurobond issuances. Disbursements from other concessional sources, however, have fallen since 2017 as well as disbursements from bilateral sources”.

Currency Composition of External Debt

The finance ministry pointed out that USD-denominated debt accounted for 70.0% of the external debt portfolio. The EUR-denominated debt was 17.3% and CNY-denominated debt (3.8%) at the end of December 2020.

Interest Rate Structure of External Debt

Furthermore, the finance ministry provided information on the interest structure of the country’s external debt. It pointed out that interest-free debt consists of subsidized loans from some bilateral creditors. However, the ministry noted that its share continues to dwindle in the external debt portfolio. This is attributed to a decline in such loans in recent years.

“The interest rate on the external debt portfolio is largely fixed. Total fixed-rate debt and variable rate debt constitute 87.5 percent and 11.9 percent of external debt, respectively. Interest-free loans account for 0.6 percent of total external debt as at End-December 2020”.

Implications on the economy

The increasing interest payments will result to government spending a chunk of the country’s meager resources to pay off these debts. As such, the state has to use its tax revenues to settle debts instead of using them to provide essential services for its citizens. Thus, Funds may not be available to the government to undertake important projects like the Free SHS. Other Important projects such as the construction of roads, hospitals, schools among others may also not receive enough funding.

Moreover, the high-interest payment coupled with unbudgeted COVID-19 expenditure will place so much burden on the government. As a result, the state may also not be able to meet employee’s agitation for wage increments.

Therefore, the ordinary Ghanaian will bear the brunt of the rising interest rates as a result of increasing government borrowing. This will then lead to an additional imposition of taxes just as the government has outlined in its 2021 budget statement.

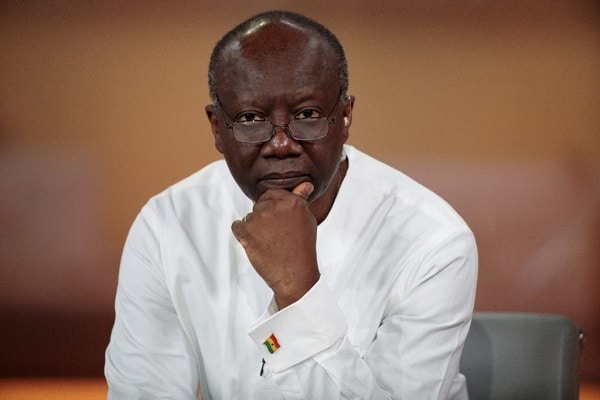

READ ALSO: Parliament Approves Ken Ofori-Atta As Finance Minister