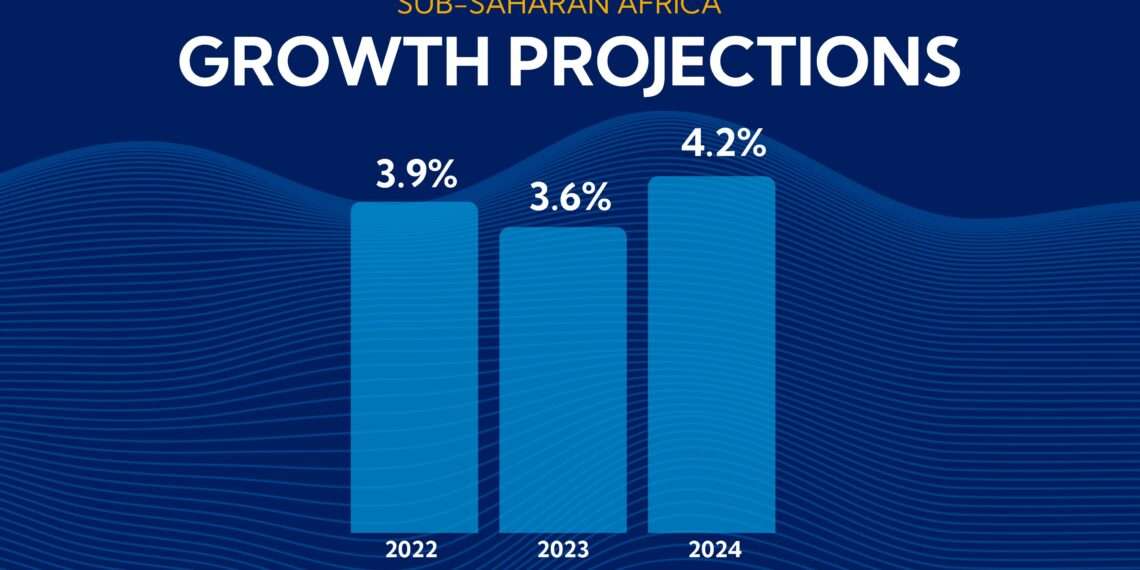

The International Monetary Fund (IMF) in its July 2023 World Economic Outlook update, has projected growth in sub-Sahara African economies “to decline to 3.5 per cent in 2023 before picking up to 4.1 per cent in 2024”.

The International Monetary Fund “Growth in Nigeria in 2023 and 2024 is projected to gradually decline, in line with April projections, reflecting security issues in the oil sector”.

According to the IMF, growth is expected to decline to 0.3 per cent in 2023 in Southern Africa.

Meanwhile, the tumble reflects power shortages, although the IMF said the forecast has been revised upward by 0.2 percentage point since the April 2023 WEO, on account of resilience in services activity in the first quarter.

Meanwhile, global headline inflation is set to fall from an annual average of 8.7 per cent in 2022 to 6.8 per. cent in 2023 and 5.2 per cent in 2024, broadly as projected in April, but above pre-pandemic (2017–19) levels of about 3.5 per cent.

About three-quarters of the world’s economies are expected to see lower annual average headline inflation in 2023.

Monetary policy tightening is expected to gradually dampen inflation, but a central driver of the disinflation projected for 2023 is declining international commodity prices, the update noted.

The IMF explained that the differences in the pace of disinflation across countries reflect such factors as different exposures to movements in commodity prices and currencies and different degrees of economic overheating.

The forecast for 2023 is revised down by 0.2 percentage point, largely on account of subdued inflation in China.

However, the forecast for 2024 has been revised upward by 0.3 percentage point, with the upgrade reflecting higher-than-expected core inflation. Core inflation is generally declining more gradually, the IMF added.

Inflation Set to Decline

Globally, the Fund said inflation is set to decline from an annual average of 6.5 per cent in 2022 to 6.0 per cent in 2023 and 4.7 per cent in 2024.

It is proving more persistent than projected, mainly for advanced economies, for which forecasts have been revised upward by 0.3 percentage point for 2023 and by 0.4 percentage point for 2024 compared with the April 2023 WEO.

Global core inflation is revised down by 0.2 percentage point in 2023, reflecting lower-than-expected core inflation in China, and up by 0.4 percentage point in 2024.

On an annual average basis, about half of economies are expected to see no decline in core inflation in 2023, although on a fourth-quarter-over-fourth-quarter basis, about 88 per cent of economies for which quarterly data are available are projected to see a decline. Overall, inflation is projected to remain above target in 2023 in 96 per cent of economies with inflation targets and in 89 per cent of those economies in 2024.

Meanwhile, growth across the region varies from country to country. Some countries, particularly those in the East African Community, or non-oil resource intensive countries, are expected to fare better but some major economies bring down the average SSA growth rate, like South Africa where growth is projected to decelerate sharply to only 0.1 percent in 2023.

According to the IMF, the rapid tightening of global monetary policy has raised borrowing costs for SSA countries both on domestic and international markets. All sub-Saharan African frontier markets have been cut off from market access since spring 2022. The US dollar effective exchange rate reached a 20-year high last year, increasing the burden of dollar-denominated debt service payments. Interest payments as a share of revenue have doubled for the average SSA country over the past decade.

READ ALSO: GSE Records Uptick Driven By Buyers’ Appetite for Blue Chip Stocks