Mr Joseph Poku, Chief Actuary at the Social Security and National Insurance Trust (SSNIT), has called for an increment in the statutory retirement age from 60 to 65 years to sustain contributions to the fund.

According to the Chief Actuary at the Social Security and National Insurance Trust, the reason for the call is that there is increasing benefits payouts due to number of workers retiring. As such, he noted that the increment of retirement age would help SSNIT accrue adequate funds as contributors stayed longer on the scheme.

“There is currently advancement in medicine and overall well-being, making it possible for people to live longer and stronger. The retirement age should be increased gradually to 65 years. By so doing, we can accumulate more funds which we can use to sustainably fund payments.”

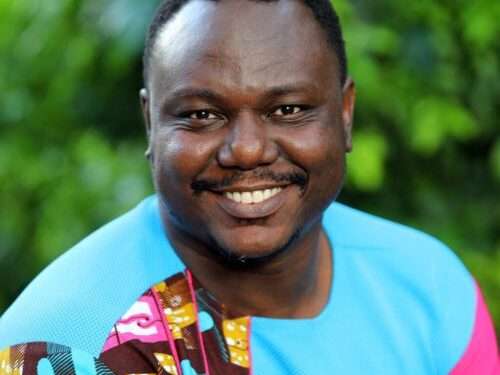

Mr Joseph Poku

Mr Poku made this known at the Pensions Conference 2022 organised by Penguard Business Solutions and Consulting and Ghanatalk Business. The event which brought together stakeholders in the Pensions industry was on the theme, ‘Sustainability of Ghana’s Pensions through Reforms and Effective Management’.

The Chief Actuary moreover, disclosed that the Scheme is also proposing an increment in the 11 per cent contributions from contributors as the current amount is low compared to the return benefits from the scheme.

Mr Poku, however, denied accusations that pensioners are not receiving the benefits due them after their retirement. He stressed that the benefits they receive is a reflection of the contributions made on their salaries.

Madam Elizabeth Birago Yeboah, the Lead Pensions Consultant at Penguard Business Solutions and Consulting, explained the importance of the event, iterating that the event sought to bring together stakeholders in the pensions industry to deliberate on its sustainability.

Madam Elizabeth Birago Yeboah called on pension funds to adopt regulatory reforms to sustain contributions amidst evolving demographic development such as climate change and crisis.

The Lead Pensions Consultant further opined that there is the need to redesign and digitilise their services to meet current market needs to attract more persons to the funds, especially those in informal sector.

Since 1992, the compulsory retirement age has been pegged at 60. At the time, the average life expectancy was 57.4 years. 30 years down the line, life expectancy has increased to 64.4 years and the compulsory retirement age is still the same although other aspects of the country’s retirement and pensions policy have been reviewed.

Recently, a similar call was made by the Director-General of the Social Security and National Insurance Trust (SSNIT), John Ofori-Tenkorang at an open forum in Accra. He argued that “After 75 years, we’ll continue to pay you until the good Lord calls you home. So in theory, SSNIT can be paying till you are 101 years. The liability that SSNIT takes on can increase enormously as long as people are living longer.”

READ ALSO: Bank of Ghana Advises Exporters to Embrace the LOC Document