Interest rates has risen marginally on the Treasury market as government secures more than 21.43% from its latest Treasury bills sale.

The increase in interest rates was expected due to the hike in the policy rate of the Bank of Ghana to 29.5%, last Monday, March 27, 2023 – to check the high inflation.

However, some market watchers argue that the cost of borrowing which is lower than the yield on Treasury bills could force investors to prioritize foreign currency investments.

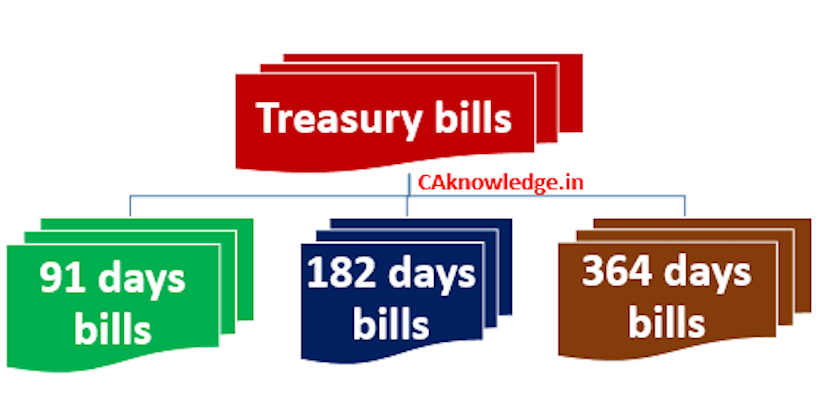

Both the 91-day and 182-day T-bills has gone up marginally by 0.51 and 0.42 percentage points to 19.38% and 21.85% respectively. Nonetheless, the government obtained ֯¢1.62 billion from the T-bills auction.

About GH¢1.25 billion of the bids came from the 91-day bills, with about ¢1.24 billion accepted.

For the 182-day T-bill, the bids were estimated at about ¢367 million. A little above ¢355 million cedis were however accepted.

BoG Raises $1.8bn From 14 day, 56 day bills at 29.8%

The Central Bank of Ghana (BoG), in its recently held auction of 14-day and 56-day bills, raised a total of GHS 10.6bn ($1.8bn) at an interest rate of 29.5% and 30.2% respectively (an average interest rate of 29.8%).

The bills were auctioned on March 29, 2023, and the results revealed today 3rd April, 2023, indicates that GHS 8.3bn and GHS 2.3bn were raised from the 14-day and 56-day bills respectively.

The Central bank’s bills are widely used by central banks as a monetary policy tool to regulate money supply by managing the liquidity of the banking system through the sale of short-term securities on the primary market.

The funds raised from the auction of the BoG bills are typically directly loaned to the government to support its short-term financing needs.

Furthermore, the interest rates set by the BoG on the bills are a key factor that determines the monetary policy stance or rate. The high interest rates of 29.5% and 30.2% set for the 14-day and 56-day bills respectively may indicate the BoG’s intention to maintain a tight monetary policy stance to curb inflationary pressures in the Ghanaian economy.

However, such high interest rates may also have adverse effects on the economy – as it increases the cost of borrowing and reduce consumer and investor confidence.

The BoG’s recent auction of bills highlights the challenges faced by the Ghanaian economy and the central bank’s efforts to address these challenges through monetary policy tools.

Read also: Dr. Atuahene Calls For Re-channeling Of FSF To Strengthening Banks’ Recapitalization