Lucid Motors, the electric vehicle manufacturer, is downsizing its workforce by about 400 employees, which accounts for roughly 6% of its total staff.

This move is part of a strategic restructuring effort as the company gears up for the release of its inaugural electric SUV later this year.

According to a regulatory filing made on Friday, May 24, Lucid Motors anticipates finalizing the restructuring by the end of the third quarter.

The process is expected to incur costs ranging from $21 million to $25 million.

This recent round of layoffs follows a significant reduction in the workforce, with Lucid Motors having cut 1,300 jobs just over a year ago.

“I’m confident Lucid will deliver the world’s best SUV and dramatically expand our total addressable market, but we aren’t generating revenue from the program yet,” CEO Peter Rawlinson said in an email to the company.

“As always we must remain vigilant about costs. We are optimizing our resources in a way we believe will best position the company for future success and growth opportunities as we focus on achieving our ambitious goals.”

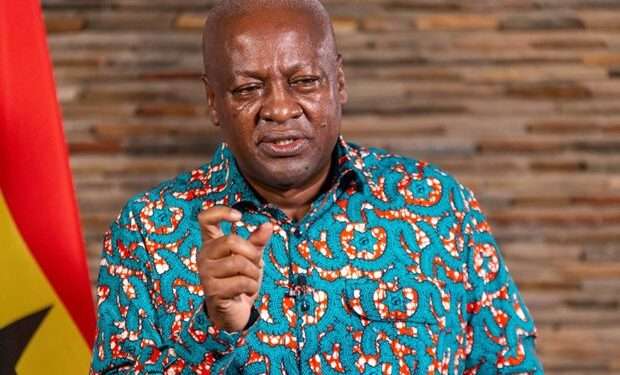

Peter Rawlinson

Peter Rawlinson, Lucid Motors’ CEO, revealed that the layoffs will affect both the company’s full-time employees and contracted workforce, targeting positions in leadership and mid-level management.

However, hourly manufacturing and logistics staff will remain unaffected by these cuts.

This move by Lucid comes amidst a wave of downsizing across the electric vehicle industry, with Tesla notably reducing its workforce over the past month.

This trend reflects a broader cooling down in growth for electric vehicle companies across North America, following a period of rapid expansion.

Lucid Motors, in particular, has faced challenges in attracting buyers for its sole existing model, the Air sedan.

However, despite these hurdles, the company achieved a delivery milestone in the first quarter of 2024.

Additionally, Lucid secured an additional $1 billion in funding in March 2024, with the majority of investment coming from Saudi Arabia’s sovereign wealth fund.

The injection of new funds follows shortly after Lucid’s announcement to investors that it intends to manufacture approximately 9,000 units of its Air electric vehicles this year, marking a modest increase from the previous year’s production levels.

Despite this, Lucid reported a significant loss of $2.8 billion in 2023, ending the year with nearly $1.4 billion in cash and equivalents.

Lucid has faced challenges in attracting buyers for its high-priced Air sedan, prompting the company to slash prices multiple times in recent months in an attempt to stimulate sales.

Additionally, Lucid has plans to commence production of its electric Gravity SUV by the end of this year.

Cautions Against Overreliance on Funding

Lucid announced the investment less than three weeks after CEO Peter Rawlinson told the Financial Times that he was wary of relying too heavily on Saudi Arabia to keep shoveling money into its proverbial furnace.

“If I adopt a mindset that there is bottomless wealth from PIF, that is very dangerous, that is something I will never do, I respect them far too much for that,” Rawlinson said at the time.

According to experts, Lucid’s conservative production target of 9000 units reflects the company’s struggle with demand for its luxury sedans.

Interestingly, this number represents only around 10% of the 90,000 EVs they initially predicted they could manufacture and sell in 2024 when they went public three years ago.

Despite these challenges, Lucid aims to turn profitable on an adjusted EBITDA basis for the first time in 2024, with revenue expected to grow by 70% to $6.0 billion while narrowing their net loss to $1.1 billion.

However, the company faces risks such as supply chain disruptions, regulatory hurdles, and competitive pressures as it strives to establish itself in the EV industry.

READ ALSO: Attorney-General Urged to Resign Amidst Allegations of Misconduct