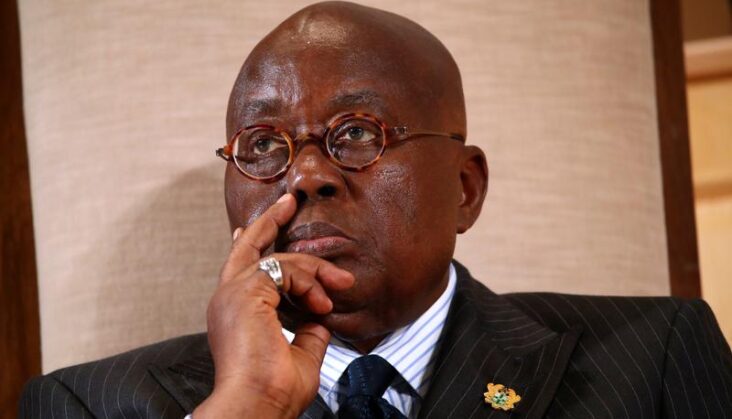

The Food and Beverages Association of Ghana (FABAG) has expressed concerns with the three new taxes assented by President Akufo-Addo, especially its impact on the business community.

According to the association, President Akufo-Addo’s assent is not only disappointing but portends a negative impact on businesses in the country. Having kicked against the idea of the passage of these new taxes, it argued that the President’s assent has made FABAG gravely worried about how businesses risk being crippled.

“This is very disappointing because a death warrant has been signed for firms. I will also say it’s a complete contradiction of the mantra of the government on 1D1F. Government has shot itself in the foot because you can’t say you are promoting industry and then come out with taxes that will kill the industry. It is mind blogging the way we run our system.”

Food and Beverages Association of Ghana

John Awuni, Executive Chairman of the Food and Beverages Association of Ghana, reckoned that Ghana’s system of taxes is not engineered in a way to create room for industry to grow. This, he explained, is because issues of industry development remain the same.

“Nothing has changed and when we talk about promoting industry, you come in with this whole array of taxes that are basically killer. It is shocking.”

Food and Beverages Association of Ghana

Meanwhile, the Ghana Union of Traders Association (GUTA) has expressed similar concerns about the passage of the taxes. It revealed that government failed to engage the union on concerns raised about the taxes when it petitioned the presidency and parliament.

Following this, the President of GUTA, Dr. Joseph Obeng, stated that the business community is not happy with the decision.

“It’s very unfortunate the business community will be directly affected and it’s very unfair. It doesn’t augur well for the democracy we are practicing here and that we are practicing democracy of imposition. We petitioned the President and Parliament and none of them replied.”

Dr. Joseph Obeng

IEAG and GFL express reservation over three new taxes

Prior to this, the Importers and Exporters Association of Ghana (IEAG) and the Ghana Federation of Labour (GFL) called for a re-engagement on the revenue bills before the President’s assent. To this end, they urged the President not to assent to the bill as it was against the interests of the growth of businesses – both manufacturers and importers.

Executive secretary of IEAG, Samson Awingobit, opined that once the President go ahead and sign, the business community would meet and decide the way forward and what actions to take, since implementing the bills would lead to suffering for businesses, government revenue, and the public.

Mr Abraham Koomson, Secretary General of GFL, on the other hand, noted that since the government did not engage the unions and businesses before pushing for the passage of the bill, it would not even rake in a quarter of the projected annual revenue of GHC4 billion it hopes to attain.

It will be recalled that President Akufo-Addo assented into law three new tax bills namely, the Excise Duty Amendment Bill 2022, the Growth and Sustainability Levy Bill, 2022, the Ghana Revenue Authority Bill 2022 and the Income Tax Amendment Bill 2022 after they were passed by parliament.

The taxes, according to government, are also crucial to help secure Board Approval for the US$3 billion International Monetary Fund (IMF) Programme after a staff-level agreement was reached late last year.

Information Minister, Kojo Oppong Nkrumah, speaking on the issue, indicated that the President’s lawyer, Kow Essuman, confirmed the assent to the bills which have since been returned to the Clerk of Parliament for the final processes to be completed.

READ ALSO: We Will Not Do Anything Contrary To The Existing MoU Between Us And Government- TUC