Summary of Issues

- The operations of GNPC raise significant debt concerns. Cumulatively, the Corporation’s actions could cost Ghana between $5 billion and $6 billion in the short to medium term.

- In 2022 alone, the Corporation programmes to make a loss of $195.25 million.

- While it shows loss-making ventures in its work programme, the Corporation seeks to hide profitable businesses offshore. A case in point is the 7 percent interest in Jubilee and TEN fields hidden in the Cayman Islands through Jubilee Oil Holdings Limited (JOHL) and seeking to collateralize the asset for loans.

- GNPC buys gas at $6.08/MMBtu and sells to its favourite, Genser, at $2.79/MMBtu, which would further be discounted to $1.79/MMBtu in an amended agreement for 16 years, creating a direct subsidy of $1.5 billion.

- According to GNPC, Accounting for Genser subsidy means the cost of gas for the market should be $7.9, not $5.9 as approved by PURC. This creates a gap of $3.6 billion to the sector if PURC does not increase the tariff to punish other consumers.

- GNPC enjoys significant government support and Parliamentary oversight failure to perpetuate these loss-making adventures. It is even worrying to note the complicity of the Ministry of Finance, which is currently in talks with the IMF for a bail-out far less than the orchestrated losses of between $5 billion and $6 billionfrom GNPC’s decisions. It tells why some have little faith in an IMF deal if we get one.

1.0 Introduction

Ghana’s balance of trade significantly relies on the extractive sector. Evidence suggests that this would not change in the short to medium term. A trend analysis of Ghana’s exports shows a significant positive correlation between extractive (mainly gold and oil) exports and total exports (Fig.1). This relationship generates direct revenue to the state and indirect benefits such as PAYE, sustenance capital and economic linkages to the extractive sector. This reality requires that state entities in the extractive sector are prudent in decision-making to limit shocks induced by the external commodity market and its attendant cyclicality.

In the petroleum sector, GNPC has the foremost responsibility per its establishing Act to “promote the exploration and the orderly and planned development of the petroleum resources of Ghana“. Unfortunately, the Corporation has been supervising chaos and uncoordinated dissipation of resources in recent years. As a result, it has become routine for GNPC to program to make losses while ignoring all caution and playing to the clientelist culture, typical of many national oil companies worldwide. In 2020, the Corporation cost the nation about GHS1.6 billion in losses, which is estimated to be worse in its 2021 reports and, definitely, in 2022.

While the Corporation is on this loss-making adventure, supervisory agencies of government, particularly the Ministry of Finance, Ministry of Energy and Parliament, are grossly complicit in either directing or ‘playing ostrich’ with the operations of the Corporation.

In this brief, we examine unfolding events that further threaten the sustainability of the Corporation and, to a broader extent, the fiscal stability of Ghana. These include the Corporation’s programmed losses for the year, operations of Jubilee Oil Holdings, and the Gas Sales Agreement (GSA) between GNPC and Genser.

1.1 Programmed Losses for 2022

In July 2022, Parliament approved GNPC’s work program for 2022, seven clear months into the financial year. The late approval of the Corporation’s spending has become normalized in recent years, exposing Parliament’s complicity in the poor management of the Corporation. In that work program, GNPC programmed to make losses of about US$195.25 million and yet got unanimous

approval from Parliament without any clear direction on how the Corporation is restructured to generate value rather than the loss-making route. The Corporation programs to make losses from both its oil and gas businesses.

The Corporation programs to spend US$1.285 billion in 2022 against projected receipts of US$1.090 billion, implying about 15 percent losses expected in 2022. The expenditure plan of the Corporation shows a list of avoidable expenses if it were to focus on its core business of exploration, development and production of the country’s oil resources.

The following worrying observations can also be made from the Corporation’s work program:

i) Liquified Natural Gas (LNG) business

The Corporation has programmed US$52.35 million as Terminal Availability Fee for its LNG business with Tema LNG, assuming unnecessary liabilities that further deteriorate its financial position. GNPC has always maintained that its business was limited to the offtake of the commodity, not guaranteeing the construction of the Tema LNG Terminal, as industry experts pointed out. If this were true, the Corporation’s liability would be limited to the commodity supply yet to materialize. It is, therefore, surprising to see the Corporation program pay Terminal Availability Fees for a project it claims not to have securitized. Contrary to its earlier positions, it is evident that the Corporation has indeed guaranteed and bundled the construction of the terminal, and the commodity supply contracts against all credible and reasonable caution on the financial implications of doing so.

ii) Weak Reporting

Before 2020, the work programs of the Corporation submitted to Parliament included statements of actual revenue and expenditure for the previous year and variance analysis, which provides much detail into how the Corporation is run. This feature was, however, missing in the 2021 and 2022 work programs without any objection from Parliament. The deteriorating reporting standards from the Corporation hampers transparency and accountability in the management of the national oil company.

iii) Fixation on landed property acquisitions

The Corporation programmes to spend US$63.9 million to acquire corporate offices and other landed assets in 2022. This expenditure alone is about 33 percent of the losses expected in 2022. The programmed expenditure for 2022 adds up to the US$73.87 million spent between 2016 and

2021 on refurbishing its landed properties, some of which have been abandoned to rot. In addition, the Corporation has failed to provide a convincing justification for acquiring and maintaining multiple offices and residences, lending credence to the perception that these acquisitions are procurement motivated.

iv) The Voltaian Basin Project

Since 2012, GNPC has been operating the Voltaian Basin project to build its capacity in upstream petroleum operations. The Corporation set for itself a 5-year timeline, i.e., 2015 to 2019, to establish prospectivity and enhance its knowledge base on the Voltaian Basin with an estimated US$60 million. Within this timeline, it had targeted to acquire seismic data and drill two conventional wells. As of the end of 2021, the Corporation has spent a total of US$93.42 million on its operations in the Voltaian Basin. Interestingly, after spending nearly US$100 million on data acquisition without drilling the two conventional wells, the Corporation programs to spend another US$35.01 million on data acquisition in 2022. The recurrent expenditure on data acquisition has created the perception among industry experts that the Voltaian project is just an expenditure line to account for the Corporation’s below-the-line expenses.

1.2 Jubilee Oil Holdings

Last year, GNPC acquired a 7% interest in Jubilee and TEN oil fields for about US$164 million from Occidental (Oxy) through a process that breached the law and hid Ghanaian assets from all the accountability mechanisms established for the efficient management of petroleum revenues. The Ministries of Energy and Finance loaned tax revenue from Oxy to GNPC to pay for the acquisition of the 7% interest. At the time of the acquisition, the 7 percent interest was held by Jubilee Oil Holdings Limited (JOHL) through Anardako WCTP, Oxy’s Ghana registered subsidiary. Instead of acquiring the 7 percent interest, GNPC acquired JOHL in the Cayman Islands, which subsequently became independent of any local company. The process breached both the Constitution and the Petroleum Revenue Management Act (PRMA) in the following respects:

i) Tax revenue from Oxy’s sale of assets constitutes petroleum revenue in accordance with the PRMA and should have been paid into the Petroleum Holding Fund (PHF). ii) Parliament must approve the appropriation of all revenues per the Constitution. However, the Ministry of Finance granted the use of the tax revenue without Parliamentary approval.

iii) Lending government revenue to JOHL, a Cayman Island registered company, constituted an international commercial transaction governed by specific rules and Parliamentary approval requirements under the Constitution. Therefore, the Ministries of Energy and Finance could not grant the loan without parliamentary approval under the law.

ACEP’s prompting of the breach of the Constitution and the PRMA on oil revenue appropriation has not yielded the needed remedy to the breaches.

1.2.1 Operations of JOHL

For ten months since the acquisition, JOHL had operated in Ghana’s upstream petroleum sector without registration in Ghana as required by Ghanaian law. Again, contrary to an earlier communication from GNPC that it intends to transfer the acquired interests to Explorco, its subsidiary, the Corporation only recently registered JOHL as an external company, maintaining its foreign identity, which emphasizes the earlier civil society position that the government intends to hide the assets. The following specifics further reinforce this position:

- The 2022 work programme of GNPC is silent on the operations of JOHL. Interestingly, all the nonperforming subsidiaries and liabilities of the Corporation are listed with expenditure lines for Parliamentary approval. However, JOHL, which could generate about US$300 million in revenue at the current oil price, was omitted for Parliamentary approval.

- Having worked for almost one year in Ghana, there is no trace of JOHL’s operations in the accountability reports issued within the period from the Ministry of Finance and the Bank of Ghana. Therefore, to date, it is difficult to verify the liftings of JOHL and how much revenue to the company, from which GNPC paid $60 million[1] to the Ministry of Finance.

- GNPC is determined to hide the asset in the Cayman Islands for as long as possible. The Corporation has brought JOHL into Ghana as an external company, and one of the company’s directors in Caymans has changed from Dr K.K. Sarpong to OpokuAhweneeh Danquah. Yet, GNPC decided not to bring the company to Ghana as a local company or transfer the interests to Explorco as initially indicated by the Corporation.

1.2.2 Collateralizing future cashflow from JOHL

Recent intelligence gathered on the Cayman Islands registered company indicates that GNPC has proposed to the Ministries of Finance and Energy to collateralize the future flows of the company for a loan of US$500 million. The Corporation intends to use US$110 million of the US$500 million loan to settle the loan advanced to it by the Ministry of Finance to acquire the interests. This comes on the back of the Corporation’s claim that it had paid US$60 million of the Ministry’s loan, even though there is no trace of this payment to the Ministry of Finance. The Corporation plans

The Corporation claims that it has paid US$60 million of the 164 million the Ministry of Finance advanced to it for the acquisition.

to spend the remaining $390 million on its exploratory activities, significantly with nonperforming contractors.

The proposed collateralization raises critical accountability questions:

- Payments to Finance Ministry – GNPC claims it has paid $60 million to the Finance Ministry. However, this payment cannot be traced in the government’s petroleum reports. This is an entrenchment of the breaches inflicted on the PRMA in relation to the acquisition of the 7% interest. Therefore, the Ministry of Finance needs to account for the $60m payment made to it.

- Borrowing for exploration is too risky – the Corporation intends to take on excessive risk by borrowing with interest to finance exploration instead of committing portions of its free cash flow as generally done by oil companies.

- Most of the programmed oil blocks for investments are not performing – the Corporation intends to spend the $390 million of the loan on Explorco exploration costto-first-oil in Eni Block 4, Springfield WCT-2, GOSCO OWST, Base Energy (ESWT), Eco Atlantic DWCTP-WO and other anticipated upstream investments. Apart from Block 4 and WCT-2, which have made some discoveries, the rest of the blocks still require financially credible investors to operationalize the terms of their respective agreements. Those blocks have been active for almost a decade without significant work. In an ideal situation, all the companies should have lost the blocks for non-performance and non-compliance with their agreement and the laws of Ghana.

It must be emphasized that, the incentive for a national oil Corporation to hide the asset from its primary owners, citizens, can only be corruption. The assets acquired sits in Ghana and therefore remains unjustifiable why it should be controlled by a foreign entity.

1.3 Gas Sales Agreement (GSA) between GNPC and Genser

ACEP and Imani have sighted the Gas Sales Agreement (GSA) between GNPC and Genser, a private company. Prior to this recent development, the contract was kept secret from other agencies and regulators in the energy sector. In various instances of request, GNPC denied the public and the agencies access to the contract, creating suspicions and wonder about why the Corporation was determined to keep the agreement concealed. It turns out that the terms of the contract are not only repulsive but also unconscionable.

The content of the contract breaches public interest and trust in the fiduciary responsibility of the Corporation. Worse, the government endorsed the agreement and a complex support structure for the private company to undermine state interest, institutions and laws in the gas sector without any strategic benefit to the state.

1.3.1 The cost of the GSA to the state

Two agreements are at the heart of the current discussions on the GNPC-Genser deal. In 2020, the Corporation signed an agreement with Genser to sell gas at $2.79/MMBtu. This reduced the cost of gas from the PURC-approved rate of $6.08/MMBtu, creating a discount of $3.29/MMBtu. The same agreement was amended in 2021 to further reduce Genser’s gas cost to $1.72/MMBtu, which deepens the deficit to $4.36/MMBtu on the 2021 regulated market price approved by PURC. The $4.36/MMBtu discount creates a subsidy of about $1.5 billion for Genser.

In its 2022 tariff proposal to the PURC, GNPC assumed a realistic gas market price of 7.9/MMBtu for all power companies but Genser. However, the PURC approved $5.9/MMBtu[1], creating an under-recovery of $2/MMBtu for the gas market. To worsen this, Genser’s heavily discounted gas price of $1.72/MMBtu at the projected gas supply of about 320mmscf/d will create a cumulative cost of about $3.6 billion for the industry in the 16 years of the agreement if the PURC does not punish the other gas consumers to pay more.

GNPC has failed to justify the discount provided to Genser on the gas commodity except that the Corporation agrees to use Genser’s pipelines over the 16 years in lieu of the gas discount. It is intriguing to note that the contract indicates that GNPC only has the option to purchase a portion of the pipeline at the end of the 16 years at the cost of $33.88 million.

This raises the fundamental question of how the Corporation arrived at the $3.29 discount on the PURC’s WACOG or the $4.36 discount on their Amended contract, particularly when Ghana Gas is paid $0.723/MMBtu for gas transportation, also for amortization of their investment through loans.

Again, the contract assigns $1.02/MMBtu for processing and transportation, as shown in Fig.2 (Table B) above. How, then, does GNPC provide an additional subsidy of $4.36/MMBtu on the gas commodity? This further worsens the economics of that whole agreement for Ghana.

The $1.02/MMBtu in the amended contract appears to be another rebate to Genser for the construction of a processing plant to offtake Jubilee and TEN gas. In effect, GNPC will be selling gas to Genser for $0.57/MMBtu when Genser is able to construct the gas processing plant. This price is provided to Genser ahead of negotiations with Tullow oil on how much the gas will be sold at the end of the free foundation gas this year.

1.3.2 Consumer Pays for Transportation

Transmission cost is not a rebate on the commodity. In the gas sector, the transmission cost is determined by PURC and borne by the consumer. This cost accounts for the amortization of capital investments and the operation of the transmission infrastructure.

The Weighted Average Cost of Gas (WACOG) accounts for the commodity (gas), transmission and other costs. At the time of the contract, the transmission charge was US$ 1.0381/MMBtu. Thus, GNPC could have engaged PURC to assign the transmission component of the WACOG to refund the pipeline investment made by Genser. Therefore, the gas commodity and related charges on Genser would have been US$5.04/MMBtu. GNPC could have provided payment security for the investments to guarantee Genser’s investment instead of a discount of about $1.5 billion.

1.3.3 Price Regulation

The regulatory agency mandated to set gas prices is the PURC. By entering a long-term transportation contract with a private company, GNPC makes the regulator redundant in its function. This denies the consuming public a fair assessment and imposition of the transportation charge provided through an independent regulator. In this instance, the PURC will be compelled to absorb the $2 deficit in the WACOG or create a cumulative shortfall of about $3.6 billion in the contract period.

It is important to note that the price regulation favours GNPC to ensure that expensive gas can be comingled with cheaper gas to arrive at a fair market price. GNPC discounting some volumes of the gas at unreasonably cheap rates for its favourites creates a market distortion and unfair competition for other consumers such as VRA and IPPs that buy gas at the regulated market price ($6.08/MMBtu at the time of signing the contract).

Again, GNPC’s financial position weakens when it buys a high gas price and sells it unreasonably cheap. Currently, the government of Ghana owes $360 million to Standard Chartered Bank in drawn-down Standby Letters of Credit (SBLCs). Therefore, the current balance on the SLBCs is $140million. Suppose the OCTP partners draw down on this balance without the government replenishing it, particularly within the fiscal constraints the government currently faces. In that case, the only option is to attack the World Bank guarantees for the OCTP project. The $360 million owed does not even account for outstanding invoices of about $80 million for gas supplied that is unpaid by GNPC. The total government payment on behalf of GNPC from September 2020 to July 2022 is $563 million out of the programmed intervention of $732 million.

1.3.4 GNPC’s presentation to Parliament on the GSA

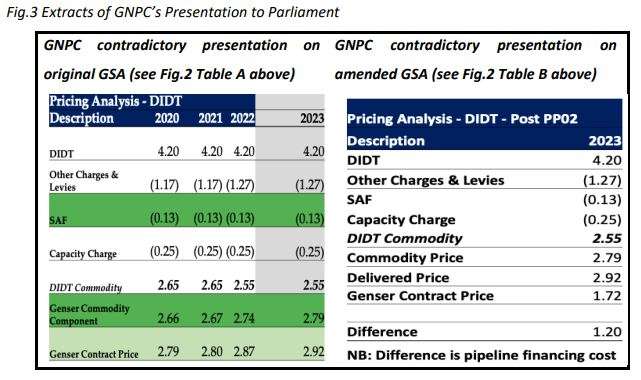

GNPC’s presentation to the Mines and Energy Committee of Parliament raises more questions than answers on the Genser transaction. The first phase, which covers the transportation infrastructure (Prestea-Damang-Nyinahin Interconnection Pipeline), attracts a price discount of $3.29/MMBtu on the $6.08/MMBtu market price to achieve the contract price of $2.79/MMBtu ($6.08 – $3.29 = $2.79). The second discount of $4.36/MMBtu kicks in, to further discount the gas price to $1.72/MMBtu ($6.08 – $4.36 = $1.72) upon completing the 72km Pipeline from Nyinahin to Kumasi (PP02).

One of the key reasons gleaned from the GSA beyond amortizing the pipeline infrastructure is that Genser will provide spare capacity on the contracted volume for GNPC to sell gas to other customers. However, the Corporation does not show how it intends to create the additional gas demand within the contract period. In fact, there is no evidence that the spare capacity will be used. Already, GNPC has provided the $3.29/MMBtu subsidy for two years without using the supposed spare capacity. Moreover, the trend in the industry shows that the throughput of 130mmscf/day to the country’s middle belt is more than adequate for the short to medium term.

Somewhat strangely, GNPC, in their struggle to explain why the discounts have been granted to Genser, Corporation presented different numbers to justify the discount given. The Corporation told Parliament, as indicated in Fig.3 that they applied the Discounted Industrial Development Tariff (DIDT) and not the WACOG approved by PURC to Genser. The current DIDT charged for industrial consumers is US$4.20/MMBtu. Using the DIDT as the base price, the Corporation further strips 30 percent of the DIDT to some unknown charges and levies of $1.27/MMBtu (the identity of every charge component on the final price from the regulator is known) in addition to a capacity charge of $0.25/MMBtu and shippers aggregate fee of $0.13/MMBtu on the DIDT to obtain the commodity price of $2.65/MMBtu. It must be noted that the DIDT is itself a discounted commodity price. Hence, it is intriguing that GNPC offers an additional $1.65/MMBtu discount on the DIDT.

The presentation is deception in the following ways;

- In the contract there is no DIDT price. The contract provides a discount for Genser to be able to make its investment

- The introduction of other charges and leviesis an afterthought to justify the price given to Genser. In the contract, the breakdown of the gas price is in Fig 2 above.

- The processing and transportation in table B of Fig.2 is a fee payable to Genser for the yet to be constructed gas Conditioning plant. How GNPC avoid the obvious can only be describes as deceptive.

- Again, post PP02, the gas price reduces to $0.570/MMBtu, not $2.92/MMBtu as told to Parliament

- GNPC completely ignored the additional elements of the Amended Contracts which brought the gas price to $0.570/MMBtu. The Corporation agreed to sell raw gas to Genser at the low price before it concluded negotiations with Tullow oil on the Post foundation gas price. If Tullow sells the gas above the $0.570/MMBtu GNPC would have to pay the difference.

This contract risks further subsidy on the commodity If the eventual commodity price is higher than Again, in GNPC’s presentation to Parliament, they sought to convince Parliament that their agreement with Genser is better than the agreement Ghana Gas had with Genser. This is completely false, given that at the time GNPC took over gas supply, Genser was buying gas from Ghana Gas at the WACOG of $6.08/MMBtu, and $7.29/MMBtu between 2018 and 2019.

Furthermore, it is important to note that in 2019, Genser applied to Ghana Gas to be charged at WACOG with the excuse that they were power producers. Subsequently, Genser reverted to the WACOG. Ghana Gas had a separate agreement to pay between $125-145 million to amortize the investment of Genser for Ghana Gas to own the pipeline in eight years. How does Ghana pay more under GNPC contract but does not eventually own the infrastructure in mind boggling.

The above shows that the attempt by GNPC to introduce the DIDT in their presentation to Parliament is an afterthought to concoct numbers that are not in the GSA in response to the questions raised by ACEP and Imani. This is why it is shocking that some Parliamentarians are convinced about the explanations from GNPC.

1.3.5 Critical Issues with The Transaction for Parliament’s Attention

It is important to highlight that any price below the market price (WACOG) is a discount. Therefore, Parliament’s interest should be in examining the cost-benefit of granting the discount to Genser. In engaging in such analysis, Parliament must take note of the following:

- GNPC’s analysis of the impact of the discount on meeting its payment obligations in the gas sector.

- The impact of the discount on the fiscal situation of the country.

- Explanations on why Genser paid $6.08/MMBtu prior to the GNPC contract but agreed to discount it to $2.79/MMBtu, further to $1.72 in the amended contract.

- Analysis of how the current arrangement with Genser fits into the ownership of the national gas transmission infrastructure system.

- Examine the discretionary granting of DIDT and its relation to national industrial policy.

- Require PURC and the Energy Commission to provide papers on the gas sector and the implications of the discount on its sustainability.

2.0 Conclusion and Recommendations

The trajectory of the Corporation raises significant economic risks, not just for itself but for the whole economy. It appears that rather than generating economic value, the Corporation is determined to derail the country’s economic progress through poor decisions. Moreover, the seeming patronage by the government and oversight lethargy by Parliament undermines any accountability in reversing this trend. This creates a complex mess for the efforts by the country to emerge from the current economic doldrums and its attendant recurrent economic supervision from the IMF.

We emphasize that correcting the inefficiencies in GNPC is critical for Ghana today and Ghana tomorrow. Therefore, while we call on all citizens, including interest groups, academia, and statesmen/women, to take an active interest in the operations of GNPC, we recommend the following set of actions:

- A public fact-finding inquiry into the operations of the Corporation must be instituted to identify the drivers of the mess and recommend a strategic path to redeem the Corporation, including holding people criminally liable for their contributions to the mess.

- GNPC must immediately abrogate the unconscionable gas sales agreement with Genser and subject the gas sector to regulation.

- GNPC must provide comprehensive information on the operations of Jubilee Oil Holdings Limited and immediately bring the asset to Ghana by collapsing tax haven entity.

- GNPC must immediately abandon their quest for LNG imports on account of the looming financial implications and optimize domestic gas production.

- Parliament must redeem its image by subjecting the Corporation to the strictest accountability and save Ghana from losing billions of dollars. The performance of the Corporation is a reflection of its function of approving the activities of the Corporation every year.