Attempted fraud within the Banking and Specialized Deposit-Taking Institutions (B&SDI) sector remains a challenge despite witnessing a minimal decline last year compared to 2020.

According to the 2021 Banking, Specialized Deposit-Taking Institutions and Electronic Money Issuers (EMI) fraud report, 2021 experienced a minimal decline of 12.09% in the number of attempted fraud cases of 2,347 for the Banking and SDI sector as compared to 2,670 in 2020.

However, the report revealed that 2021 recorded a loss value of GH¢61million as compared to a loss of GH¢25 million in 2020, representing a 144.00% increase in year-on-year terms.

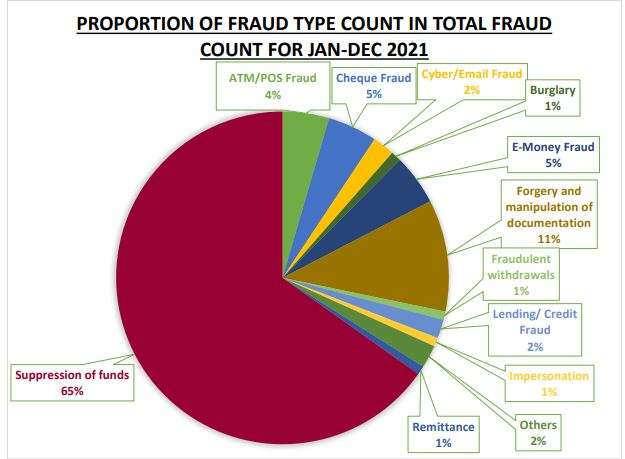

The significant fraud types that accounted for this figure included ATM card/POS fraud, impersonation, lending and credit fraud, forgery and manipulation of documents, cash suppression and E-money fraud.

The increase in usage of electronic and digital platforms in the financial sector resulted in an increase in ATM card/POS fraud. However, there were other fraud types, which also recorded some huge losses. Notable among these are impersonation, lending and credit fraud, suppression of cash, E-money and forgery and manipulation of documents.

ATM card/POS related fraud recorded the highest loss of GH¢22million. This, the Bank of Ghana, attributed to negligence of some customers and weak systems of some financial institutions.

Another significant fraud type was impersonation which recorded a loss of GH¢10million. The Regulator attributed this type of loss to lack of due diligence on the part of bank staff and customers of financial institutions when carrying out transactions. Staff involvement in fraud, which constitutes 53.46% of total fraud cases, continued to increase in the year under review.

Statistics indicate that staff involvement in fraud cases increased to 278, as compared to 253 in 2020, representing an increase of 9.88% in year-on-year terms. For 2021, the Rural and Community Banks recorded the highest rate of staff involvement in fraud with a figure of 46.04%; the Universal banks accounted for 28.06%, while the Savings and Loans companies accounted for 16.55%.

The EMI sector reported a significant number of mobile money (MoMo) fraud incidents and loss values in 2021. EMIs recorded 12,350 MoMo related fraud incidents in 2021. The total value of fraud reported by EMIs for 2021 amounted to GH¢14.2 million. Also, the total E-Money related loss recorded by EMIs in 2021 amounted to approximately GH¢12.8million.

Initiatives by the Bank of Ghana to address fraud

The Bank of Ghana stated in the report that it is strengthening its fraud monitoring activities and enforcement of required internal controls and risk governance within banks, SDIs, EMIs and other regulated entities to address the fraud cases within the sector.

“The Bank of Ghana has issued a notice to the public, banks and other regulated entities on the usage of the Ghana Card as the primary identification document for all financial transactions. All Banks and SDIs are required to pay particular attention to this directive and ensure compliance. This will mitigate the incidence of fraud in the financial sector”.

Bank of Ghana

Furthermore, BoG noted that a secretariat has been set up at the Financial Stability Department of the Bank of Ghana to coordinate the activities of the Committee for Cooperation between Law Enforcement Agencies and the Banking Community (COCLAB).

According to BoG, this is to ensure that COCLAB achieves its mandate of developing and implementing effective controls to mitigate fraud in the sector.

The Bank of Ghana has also embarked on a series of sensitization programmes in person and on television shows to educate and sensitize the public on financial literacy.

The Bank of Ghana recommended among others that E-Money Issuers should have transaction monitoring tools that can flag unusual wallet transactions and anti-fraud tools that can deactivate the flagged wallets to prevent their further usage to commit fraud.

The 2021 fraud report presents an overview of fraud typologies recorded in the Banking and SDI sector and Electronic Money Issuers (EMI) sector in Ghana.

READ ALSO: Edem Agbana Describes Protesters Attack As Self Defence