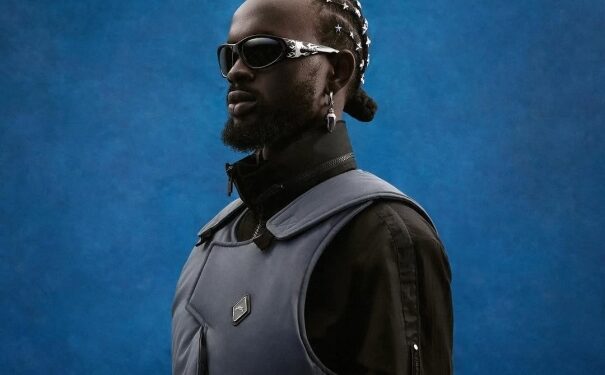

The Business Operations Manager at E-Crime Bureau, Philip Danquah Debrah, has revealed that the surge in cybercrimes within the financial institutions is as a result of the inability of these institutions to aptly manage vulnerabilities which comes with technology usage.

Speaking on the matter in an interview, Mr. Debrah said, “What makes cyber fraud possible is just because of vulnerabilities. Vulnerabilities can mean that no matter how your system is or no matter where you have acquired your applications and devices that operate your network and everything that is on your corporate infrastructure, you’re always liable to some level of vulnerability.

“In 2018, we saw the emergence of ATM fraudsters where they are able to have access by opening bank accounts and even using existing accounts and compromising ATM systems to withdraw money. That has been the trend. Now we are seeing more of e-payments across board whether ATM, mobile banking, or internet banking. We are seeing infiltration of cyber criminals to take advantage of this same vulnerabilities we are speaking about. So it tells us that we are not managing the vulnerability as effectively as we should.”

According to the latest report released by the Bank of Ghana on cyber fraud, it indicates that the banking industry, in 2019, reported a total of 2,295 fraud cases as compared to 2,175 fraud cases reported in 2018.

Citing some salient reasons for the increase in the number of fraud cases in the sector, the central bank stated that the use of advanced technology has made it easier for cyber-crime to take place.

The statement read, “Also in recent times, the various forms of advanced technologies adopted by financial institutions have made the banking sector more susceptible to various risks such as phishing, identity theft, card skimming, vishing, e-mail fraud and more sophisticated types of cybercrime.”

Commenting on the current phenomenon, Mr. Debrah entreated Ghanaians to be more cautious when using digital platforms to perform financial transactions.

“In Ghana, what we have realized is that individuals have become very big consumers of technology products and it is an area where we have to be extremely mindful of in terms of helping law enforcement to investigate some of these issues when they occur. Now, for an individual who experiences such fraud, first of all, you should know your environment. You should know the platform that you are on. You should be able to understand the risk that you are liable to experience with signing up to a number of its financial products. You have a responsibility to know the risks from the bank’s perspective. So when you’re subscribing to products, you should know the risks. In knowing the risks, you’ll then be able to help to identify anything that may have gone wrong.”

In the Bank of Ghana’s 2018 report on fraud in the banking sector, it revealed that cyber fraudsters attempted to steal at least GH¢325.9 million from financial institutions operating the country.

The report stated that the amount involved represents a 190 percent increase in the value reported in 2017.

Currently, the banking industry continues to face the issue of fraud, with the Cyber Crime Unit of the CID receiving several complaints of similar attacks against a number of banks in the country in 2020 alone.