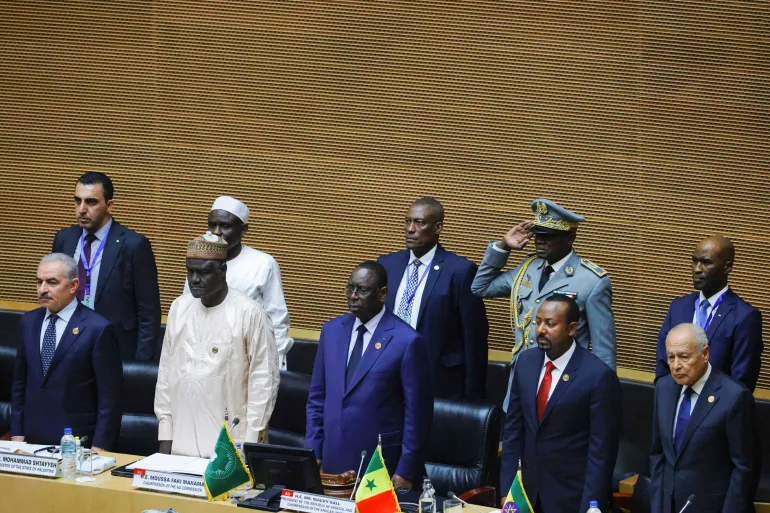

This weekend, African leaders will convene in Addis Ababa for the annual summit of the African Union (AU), focusing on crucial business matters, including initiatives to position Africa as a global economic force.

Taking center stage during the two-day high-level meeting, commencing on February 17, is a treaty heralded by the AU as a transformative force for trade in a continent where inter-country trade is lacking, particularly with a heavy reliance on imports from nations like China.

The African Continental Free Trade Area (AfCFTA) agreement, endorsed by many African countries, is set to integrate 55 economies into a unified and competitive mega market boasting a population of over a billion people, making it one of the largest free trade areas globally.

The AU anticipates that this agreement will not only enhance revenue but also uplift 30 million of Africa’s impoverished citizens. Despite the substantial excitement surrounding the treaty, practical implementation has faced delays, postponing potential benefits and raising concerns about the AU’s ability to successfully execute the plan.

AfCFTA And What It Promises

Initially established in July 2019, the AfCFTA is a pivotal component of the AU’s half-century strategy aimed at bolstering economic advancement across Africa.

At its core, the agreement seeks to enhance economic integration within the continent by facilitating the seamless and cost-effective movement of goods and services between nations, fostering cross-border investments, eliminating trade barriers, and promoting open visa policies.

Additionally, the AU envisions utilizing this framework to support local manufacturing and advocate for greater influence in global trade, where Africa presently contributes a mere 3 percent.

Except for Eritrea, all 55 AU member states have endorsed the agreement.

Their representation will be through the eight officially recognized regional economic blocs, which include the South African Development Community (SADC) and the Economic Community of West African States (ECOWAS). The treaty officially came into effect in January 2021.

The agreement symbolizes a cohesive African market comprising 1.3 billion individuals, with an approximate value of $3 trillion, akin to the gross domestic product (GDP) of India.

The AU aims to slash or remove tariffs on 90 percent of goods, anticipating an additional $450 billion in revenue for Africa by 2035. Should the agreement go as planned, the AU predicts Africa’s economy will burgeon to $29 trillion by 2050.

The Current Trade Outlook in Africa

African governments have historically implemented trade barriers to safeguard their domestic markets from regional competition.

Currently, tariffs on intra-continental trade result in goods imported from within Africa being 6.1 percent more expensive than those imported from outside the continent.

This markup hinders inter-African trade, with total intra-African exports hovering around 14 percent of overall African trade volume, considerably lower than 55 percent in Asia, 49 percent in North America, and 63 percent in the European Union.

Sub-Saharan Africa has a significant trade relationship with China. One-fifth of the region’s raw materials, including crude oil, metal, and copper, are exported to China, making it the region’s leading trade partner.

Conversely, China is also a major exporter to Africa, resulting in a prevalence of “Made in China” goods in markets across the continent, overshadowing “Made in Africa” products.

According to Olabisi Akinkugbe of Canada’s Dalhousie University, “We need to be thinking big as a continent. We continue to be seen as a raw material provider, meaning we are at the bottom of the value chain.”

He pointed out that the AfCFTA failed to address how African countries can use their minerals to tap into the ongoing global transition to green energy.

Nigeria, abundant in oil resources, operates with just two functional refineries. Consequently, the country had to export crude oil valued at about 8 billion naira ($5 million) in the latter half of 2023, while simultaneously importing refined products like petrol, amounting to 2.5 billion naira ($1.7 million).

Another issue limiting intra-Africa trade is poor connectivity. Prices of intra-Africa flights are often high and flight routes complicated.

The AU’s Single African Air Transport Market (SAATM), launched in 2022 to ease travel across the continent, has seen slow progress. ‘It is easier to fly to Europe than to fly to some African countries,’ Akinkugbe said.

In addition, several countries require visas for other Africans that sometimes take months to obtain.

According to the Visa Openness Index, only Benin, The Gambia, Rwanda, and Seychelles operate visa-free policies for all Africans. Libya, Sudan, Equatorial Guinea, and Eritrea are the least open, requiring nationals from at least 51 African countries to get a visa.

What To Expect At The Upcoming Summit

During the AU summit, member states will deliberate on various protocols embedded within the treaty.

While pivotal trading agreements and frameworks for dispute resolution have been enacted, supplementary protocols addressing intellectual property rights, gender inclusivity, and the regulation of cross-border investments and digital commerce remain outstanding. These protocols are slated for potential approval during the summit.

Mendez-Parra stated, “Negotiations concluded some time ago, but now the political process must begin and the AU giving the nod will mean that states can now move towards ratification.”

“The last summit in 2023 recognised that the AfCFTA must be complemented by other initiatives, like the African passport, the movement of people and so on. It will be interesting to see the outcomes of the 37th AU summit in terms of the future steer it will provide.”

Mendez-Parra

READ ALSO: Houthi Attacks In Red Sea Severely Disrupt Aid Flow To Sudan