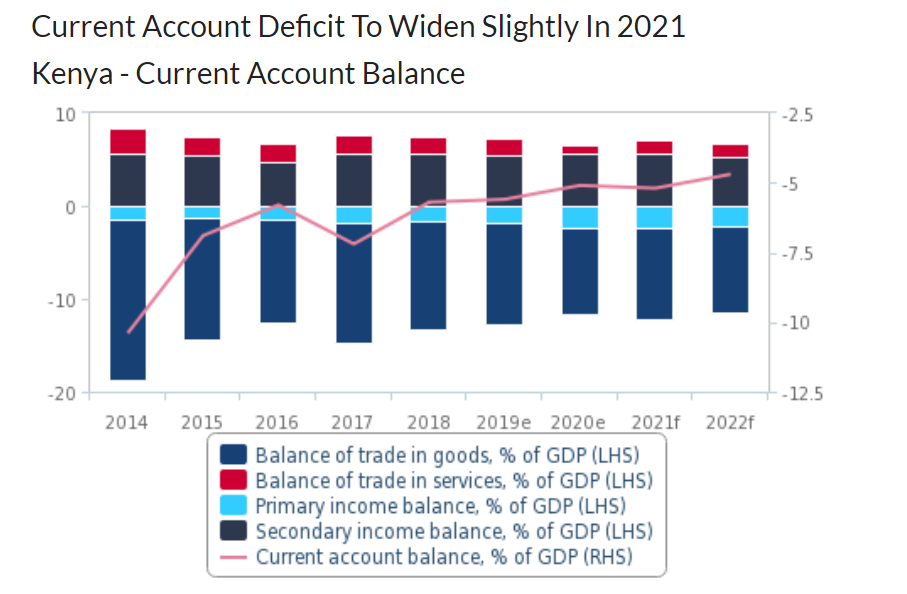

The research arm of Fitch Ratings Agency, Fitch Solutions has forecasted Kenya’s current account deficit to experience a modest rise in 2021 to 5.2 percent of GDP from 5.1 percent of GDP in 2020.

In 2020, the Coronavirus pandemic-induced trade disruptions coupled with the decline in economic activities in the domestic economy saw a modest decline in demand for imports. However, Fitch Solutions expect that demand for imports will strengthen this year, as the domestic economy begins to show signs of economic recovery and as such economic activity regains momentum over the coming quarters.

A rebirth of activity in the most hit sectors such as the tourism and travel sectors is expected to yield a slight increase in the services trade surplus this year. Contrasted with the positive outlook this year, Kenyan flights stayed aground throughout the year due to the imposition of international flight restrictions and a decline in global demand for travel. This led to the drastic reduction of tourist arrivals in Kenya’s two main international airports from 341,267 in Q2 of 2019 to 1,777 in Q2 of 2020. Although tourist arrivals recovered slightly to 34,701 in Q3 of 2020, they were just a small fraction of pre-pandemic levels.

This notwithstanding, the ongoing global rollout of COVID-19 vaccines has triggered a move by the Kenyan government to ease restrictions on foreign travel, and this turn of events is expected to contribute to an uptick in tourism inflows from Developed Markets. According to available data cited by Fitch Solutions, Kenya’s travel and tourism services account for a respective 8.8% and 15.0% of total exports, and therefore it is expected that higher receipts from these sectors will increase Kenya’s services trade surplus from USD0.9bn in 2020 to USD1.4bn in 2021.

Furthermore, the research firm, projects remittance inflows to rise steadily which will in turn contribute to the country’s secondary income account. Like other African countries, remittances provide an important source of foreign exchange for Kenya. As a way of reducing the impact of the pandemic on households, the government of Kenya reduced person-to-person fees charged on M-PESA money transfer services (which accounts for approximately 98.8% of Kenya’s mobile money market) and bank-to-phone charges from the Central Bank of Kenya (CBK) in March 2020. This move by the government lowered transaction costs and helped to offset the negative impact of falling incomes in markets such as the US and the EU.

Accordingly, remittances rose by 10.7% to a record high of USD3, 094.0 million in 2020, from USD2, 796.0 million in 2019. Albeit, Fitch believes that this observed increase in the growth of remittances will not continue into 2021. They contend that a recovery in real GDP growth from 0.1% in 2020 to 4.4% in 2021 is likely to reduce pressure on household incomes and the need for financial assistance from abroad. As a consequence, steady growth in remittances will continue this year in order to ensure a sustained secondary income surplus.

READ ALSO: Ghana ranks 4th in Green Hydrogen Index in SSA- Fitch