The Kiel Institute for the World Economy has stated in a study that China imposes unique conditions on borrowing to developing nations. These conditions, the study notes, could be giving Beijing undue influence over the borrowing countries economic and foreign policies. nations nations

The report’s authors reveal that the study analyzes 100 Chinese loan agreements with 24 countries. They also note that it represents the first systematic analysis of the legal terms of China’s foreign lending.

Carried out with support from several US research institutions, the study compares agreements made with Chinese state-owned banks against 142 publicly available contracts of other major creditor countries.

The authors concluded that the contracts “use creative design to manage credit risk and overcome enforcement hurdles”. According to them, this reveals China to be a “muscular and commercially savvy lender to the developing world.”

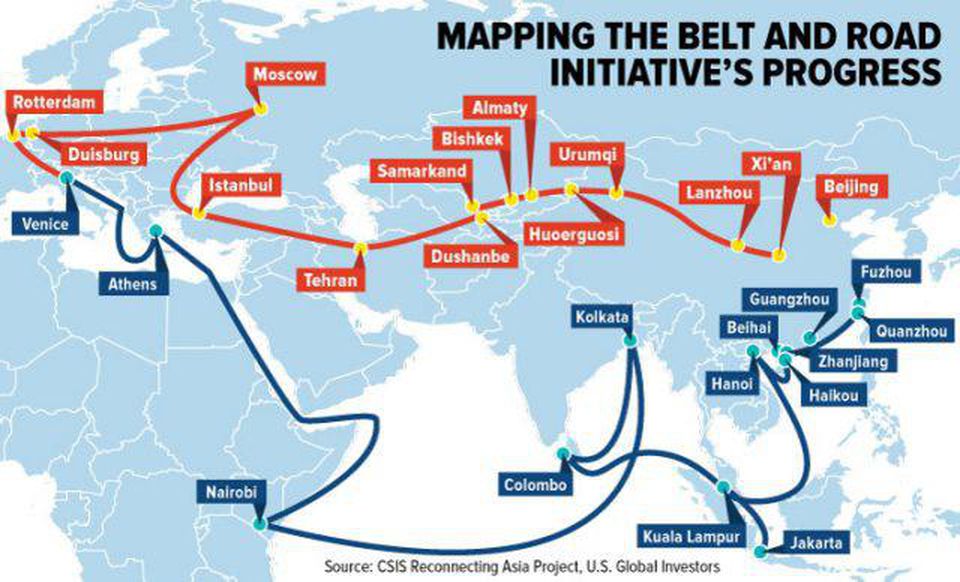

The report also discloses that much of the lending has been in the context of China’s Belt and Road Initiative. The initiative is an ambitious global infrastructure investment strategy involving over 60 countries.

China is the world’s largest public lender to developing countries.

Sworn to secrecy

The study reveals that in agreements with developing countries, China’s financing state banks establish new lending terms or adapt standard ones in ways that “go beyond maximizing commercial advantage.”

“Such terms can amplify the lender’s influence over the debtor’s economic and foreign policies.”

Giving examples, the study notes that over 90% of the reviewed Chinese contracts include a clause that allows the creditor to terminate the contract and demand repayment in the case of significant law or policy change in the borrowing country.

The researchers argue that while policy change clauses are standard in commercial contracts, this takes on a different dimension when the lender is a state entity and not a private firm subject to standard financial regulation.

The authors also found that the contracts also contain “unusually far-reaching confidentiality clauses.”

“Many of the contracts contain or refer to borrowers’ promises not to disclose their terms. Or, in some cases, even the fact of the contract’s existence.”

This secrecy also prevents other lenders from reliably assessing a country’s creditworthiness, the study notes.

“Most importantly, citizens in lending and borrowing countries alike cannot hold their governments accountable for secret debts.”

Breach of contract

Kiel Institute’s study also revealed that the contracts give Chinese state banks priority over other creditors. At the same time, many of the agreements give China “great leeway to cancel loans or accelerate repayment, if it disagrees with a borrower’s policies.”

The severance of diplomatic relations with China is also classified as a breach of contract, according to the study. Policy changes in the recipient country can also trigger a breach of contract, requiring the debtor government to repay the entire loan amount immediately.

The authors say in a normal case, the lender would choose to accelerate principal and interest repayments, rather than demand the loan be returned in full.

“Default triggers we have identified in Chinese debt contracts potentially amplify China’s economic and political influence over a sovereign borrower.”

Researchers also found that 30% of the contracts require loan-receiving countries to deposit collateral in special escrow accounts. These accounts are often held by a Chinese state-owned bank.

The borrowing countries may also be required to deposit revenue from projects backed financially by these banks into said accounts. In the event of bankruptcy, the Chinese bank could then seize these assets.

Read Also: AfCFTA, UNDP signs strategic partnership agreement