The International Monetary Fund (IMF), has stated the war in Ukraine will “severely set back” the global economic recovery with the UK hit harder than most.

The ongoing war between Russia and Ukraine is driving up food prices and fuel, which the international body (IMF)) expects to slow growth globally. It has also cut its global forecast and also downgraded its outlook for the UK. This means the UK will no longer be the fastest growing economy in the G7 Group of leading Western nations, and will as well be the slowest in 2023, the IMF added.

The body pointed out that the UK’s growth will slow as pricing pressures led households to cut spending, while rising interest rates are expected to “cool investment”. The report also predicted that the UK economy could grow by 3.7 percent this year, down from the previous forecast of 4.7 percent made in January 2022.

However, next year (2023), the UK is expected to have the slowest growth in the G7 and across Europe’s main economies, at just 1.2 percent, a near halving from the 2.3 per cent which was previously expected. The 2023 UK figure is the slowest apart from heavily-sanctioned Russia which is part of the wider G20 group, which includes nations such as China and India.

Concerns Raised

A Treasury Spokesperson disclosed that the IMF’s forecasts “will be concerning for many people and families” in the UK.

“However, the support we provided over the past two years has put our economy in a good position to deal with these headwinds, including through record numbers of employees on payrolls and a strong economic recovery from the pandemic.”

A Treasury Spokesperson

Labour’s Shadow Chancellor, Rachel Reeves, said the IMF forecast “shows the extreme challenges facing the UK economy”.

“While it is true that global forces play a role, the fact that the UK is forecast to have the slowest growth of any G7 economy next year plus the highest inflation, shows the uniquely bad situation the UK is in. Inflation spiralling out of control this year has created a cost-of-living crisis hitting families across the country, needing decisive and urgent action.”

Labour’s Shadow Chancellor, Rachel Reeves

Liberal Democrat Treasury Spokesperson, Christine Jardine, said the UK government had “failed to shield the UK from spiralling energy bills and soaring inflation, but they have gone ahead with raising people’s taxes to their highest point in 70 years”.

‘Major Shock’

The IMF works with 189 member-countries to stabilise the global economy through various means such as short-term loans and offering assistance to countries that are struggling.

It said inflation was now a “clear and present danger” in many countries and the situation has added to supply strains from the coronavirus pandemic.

IMF’s Director of Research, Pierre-Olivier Gourinchas, in the organisation’s 2022 World Economic Outlook, pointed out that “In the matter of a few weeks, the world has yet again experienced a major, transformative shock. Just as a durable recovery from the pandemic-induced global economic collapse appeared in sight, the war has created the very real prospect that a large part of the recent gains will be erased.”

The World Bank, on the other hand, said it is lowering its growth forecast from 4.1% to 3.2%. The conflict already devastated the economies of Ukraine and Russia, with Russia being cut off by the West from key trading and financial networks with sanctions, following the invasion.

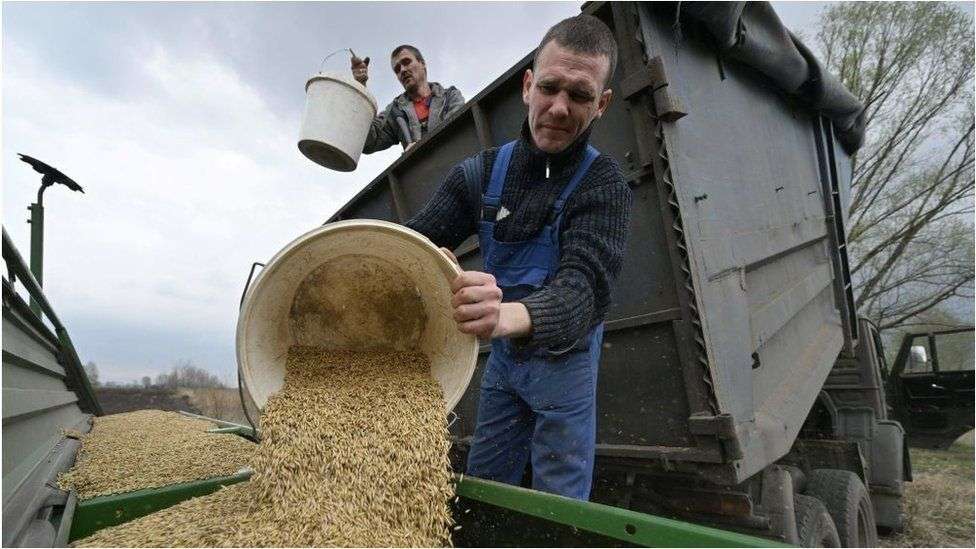

Ukraine is currently facing a severe contraction of about 35% or more this year, while Russia’s economy is expected to shrink by 8.5%, the IMF revealed. But the IMF has warned that Russia, a major energy producer and key supplier of staple foods such as wheat and corn alongside Ukraine, will face consequences that will ripple far beyond their borders. “The economic effects of the war are spreading far and wide, like seismic waves that emanate from the epicenter of an earthquake,” the IMF disclosed. Elsewhere in Germany, where the economy is especially closely entwined with Russia, the IMF foresee a lower growth by 1.7 percentage points.

The financial body also intimated that even in countries with little direct trade with Russia and Ukraine, households will feel the effects of the war, as Central Banks respond to the more rapid inflation by raising interest rates, making borrowing more expensive. In the US, for example, the IMF lowered its forecast for growth in 2022 by 0.3 percentage points to 3.7%, citing the prospect of more aggressive interest rate rises.

READ ALSO: GCB Bank’s Profit Skyrocketed By More Than 28% Margin