Oil marketing giant, Ghana Oil Company (GOIL), posted a bulge in profits of 91.17 per cent year-on-year, on the back of rising fuel prices, amid growing economic activity which largely fuelled increased consumption in the company’s products over the first quarter of 2022.

Noting the trajectory of growth over the period, the company’s unaudited financial report recorded a net profit of GHS41.87 million in Q1 2022, compared to GHS21.90 million as at Q1 2021.

Given the period under review, the company reported revenue growth of about 94.57 per cent from GHS8877.85 million in Q1 2021 to GHS1.71 billion in Q1 2022. The positive growth trajectory in revenues is juxtaposed with the rising costs during the period due to supply chain disruptions, inflationary pressures and heightened exchange rate volatilities.

Specifically, the cedi experienced the worst depreciation against the dollar comparing with other currencies besides the Russian ruble between January and March, 2022, according to Reuters data. This, therefore added to the rise in cost over the quarter.

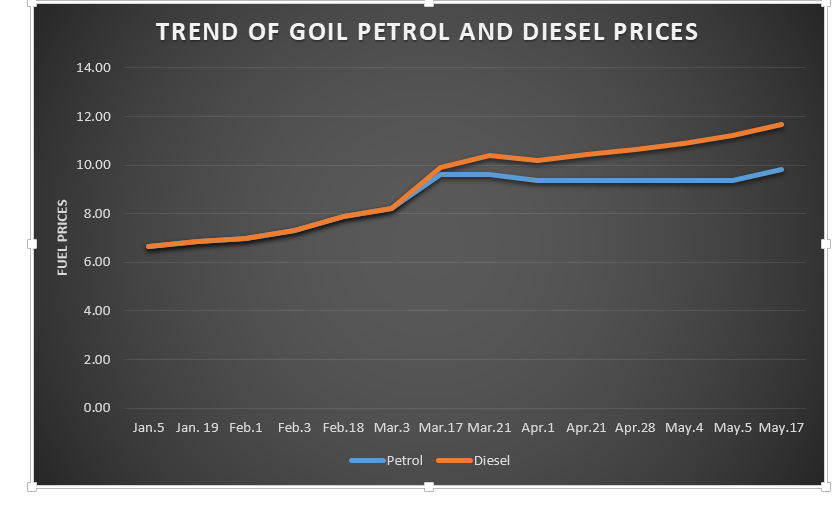

Though these macroeconomic fundamentals remain elevated, they were offset by the increased consumption in refined petroleum products and the bullish trend in prices. Considering the evolution of fuel prices charged by the company over the course of the year, prices of petrol and diesel started the year at the same price, selling at GHS6.65 per litre, however prices of petrol and diesel have so far risen by 47.4 percent and 75.8 percent respectively.

GOIL Sees Cost Rise

The Company’s unaudited financial statements, submitted to the Ghana Stock Exchange (GSE) in line with listing regulations, showed a rise in cost of sales.

The increment was nearly 99 per cent of the costs incurred in Q1 2021. In nominal terms, the company reported cost of sales of GHS1.57 billion in Q1 2022 compared to the cost of sales of GHS790.66 million in the previous year’s quarter.

The report showed that all cost lines went up. Specifically, General, administrative and selling expense rose from GHS59.76 million in Q1 2021 to GHS80.88 million in Q1 2022, representing a 35.34 per cent increase. Similarly, the company’s financial charges also increased from GHS4.56 million to GHS6.02 million within the period under review.

Owing to the rise in the company’s profits, earnings per share to the company’s shareholders rose to GHS0.107 per share for end-Q1 2022 compared with GHS0.056 per share in the previous year’s quarter.

These strong fundamentals demonstrate the boom in the downstream petroleum market. Like GOIL, companies within the downstream petroleum market value chain are expected to rake in windfall profits over the course of the year should the Russia-Ukraine war continue to remain unabated.

However, after February 18, 2022, when news about a possible Russian invasion of Ukraine sounded, market sentiments began to heighten with reports about shortage of diesel on the global oil market. Currently, the company’s price of diesel stands at GHS11.69 per litre while petrol sells at GHS9.80.

On the bright side, among the three key oil marketing companies in the downstream petroleum market aside TotalEnergies and Shell, GOIL has a large market share with the government having an interest or stake in the company. With an increase in earnings per share, dividends payable to the government are also expected to rise along side.

READ ALSO: We Need to Look Critically at how we Fight Inflation- Togbe Afede XIV