Philip Myburgh, Executive Head of Trade and Africa-China, Business and Commercial Clients at the Standard Bank Group (parent company of Stanbic Bank Ghana) indicated that amidst disruptions to traditional trade routes, unpredictable shipping times and soaring freight tariffs caused by the conflict in the Red Sea region, the opportunities the African Continental Free Trade Area (AfCFTA) agreement creates for the development of intra-Africa trade are becoming apparent.

Philip Myburgh noted that the African continent holds markets that connect 1.3 billion people with a combined gross GDP of about USD3.4 trillion. Buying and trading goods in this environment offers alternative business opportunities both now and in the future. These opportunities would ease the pressure to import goods from the rest of the world.

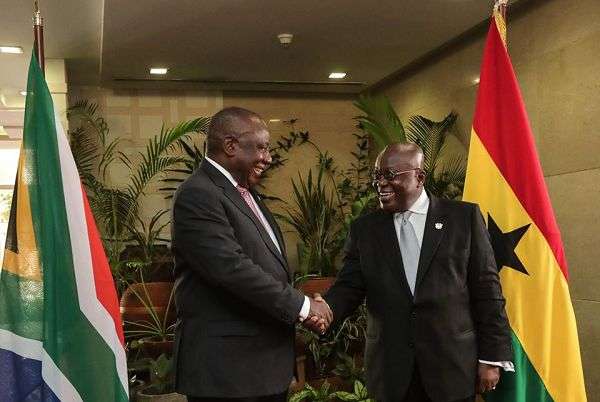

“Besides reducing the need to import goods from outside of Africa, the preferential tariff rates promote Africa’s growth. AfCFTA has the potential to boost South Africa’s economy and create new jobs by increasing economic participation. Last month, South Africa exported its first shipment of goods to Ghana under the AfCFTA agreement. The goods shipped were forged grinding balls and high-chrome grinding media products supplied to the platinum, gold, ferrochrome, base metal, power generation and cement industries.”

Philip Myburgh

Myburgh indicated that two features make Ghana a strong trading partner: its location on the west coast and its two deep-water ports. “Takoradi and Tema offer logistical advantages to seaborne traffic from South Africa. And Ghana, often called the ‘Gateway to West Africa,’ offers easy access not only to Ghanaian markets, but also to other countries in the region,” he said.

Mutually Beneficial Opportunities Between South Africa And Ghana

Myburgh highlighted some of the mutually beneficial opportunities between South Africa and Ghana. He noted that South African poultry and meat products (Broiler products account for about 80% of Ghana’s meat imports. And with a large Muslim population, there are opportunities for halal-certified imports.) “South African maize, which can generate revenue of USD100 million raw cane sugar and chemically pure sucrose, which can generate revenue of USD70 million and USD60 million, respectively”.

“Ghana, in turn, can offer the South African market: Cocoa powder and cocoa paste, valued between USD10 million and USD15million, Frozen fish valued at USD20 million. Shea butter for the expanding local hair care and skin care markets, which saw imports of 6.4 million kilograms (worth about USD20.4 million) in 2022.

“Standard Bank’s relationship with AfCFTA is focused on unlocking Africa’s potential through digital trade services and innovative technologies. These technologies include data science, AI and blockchain. We work with the AfCFTA steering committee to provide clear insight into digital trade implementation. We have strong ties with Ghana, which include full banking operations. The country is also home to AfCFTA headquarters. Ghana is dedicated to promoting growth and creating opportunities across the 20 African markets that Standard Bank serves.”

Philip Myburgh

Myburgh explained that with the continent’s young population, growing markets and opportunities for intra-African trade, the African continent has the potential to become one of the world’s major trading blocs. “And African countries and their worldwide exports will benefit. We are committed to the future of AfCFTA and the continent we serve,” says Myburgh.

READ ALSO: NDC’s General Secretary Outlines Mahama’s Policies, Focuses On ICT