Lawyers of the founder of the defunct Beige Bank, Michael Nyinaku, have disclosed to the High Court in Accra that their client was denied the opportunity to respond to queries by the Bank of Ghana (BoG) as pertains to best industry practices.

Mr. Thaddeus Sory, the Lead lawyer, averred that though the BoG had written to his client to answer to findings, the receiver of the Beige Bank and the KPMG, an accounting audit firm, denied his client, Mr. Michael Nyinaku, the opportunity upon taking over.

The Lead lawyer, while accusing the receiver of acting in “bad faith”, also accused the audit firm and the receiver of having “a special interest in the assignment entrusted to them” by the Bank of Ghana, hence they resolved not to grant the accused the opportunity he requested.

Lawyer Thaddeus Sory who was putting questions to Julius Ayivor, a Chartered Accountant with KPMG, currently on secondment to the office of the Receiver of Beige Bank as one of its lead sources, noted that the BoG had earlier written to the Beige Bank seeking its answers.

“Counsel, again put it to the witness that, by a letter dated August 1, 2018, the Bank of Ghana had informed Beige Bank that it was giving it an opportunity to regularise any adverse findings it had made against the bank.

“Because of the source of his fees, the Receiver and also KPMG have a special interest in the assignment entrusted to them by the BoG in respect of the bank.”

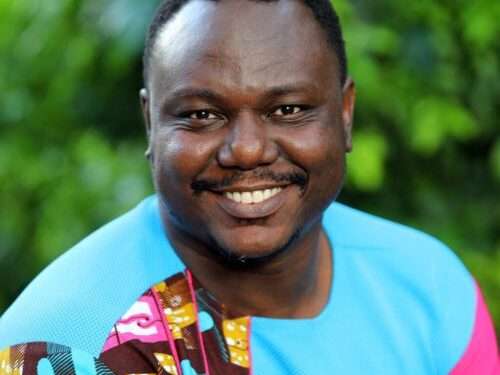

Lawyer Thaddeus Sory

Mr. Thaddeus Sory further put it to the witness, Mr. Julius Ayivor, that in that particular instance, he never gave Beige Bank an opportunity to correct any irregularities by reference to the 1st August 2018 date when he was seconded to the Receiver.

However, Mr. Julius Ayivor, the first Prosecution witness who was facing cross-examination after having earlier given his evidence in chief, disagreed.

“My lady, that would not be the case, and I would explain. On August 1, 2018, when Beige Bank’s license was revoked, all powers of management, directors, and shareholders of the bank were suspended, and those powers were reposed in the Receiver, effectively causing the Receiver to become the sole legal representative of the bank.”

Mr. Julius Ayivor

According to Mr. Ayivor, on his appointment on August 1, 2018, officials of Beige Bank, now defunct, became non-existent technically.

“The Receiver’s professional obligations in terms of the discussion of findings that were identified and determined to be irregular would be towards the BoG and then in the course of the investigations if there are any matters that require clarification, he engaged some of the ex-staff that were still at post, especially those that worked in the financial and the credit department including in some instances the accused person.

“I am not aware whether or not there were any discussions between the BoG and the former management of Beige Bank post August 1, 2018, in relation to irregular transactions that were identified.”

Mr. Julius Ayivor

Bad faith

The Counsel further put it to the witness, Mr. Ayivor, that the revocation of its license, the appointment of the receiver, and his secondment on that same day were done in bad faith.

However, Mr. Ayivor divulged that any concerns that anybody may have concerning the revocation of the bank’s license is supposed to be ironed out at arbitration.

“I am therefore not in a position to determine whether or not there is any bad faith in this case.”

Mr. Julius Ayivor

Secondment

Mr. Ayivor, the first of the seven witnesses that the state had intended to call informed the court that he was seconded to the Receiver, and that the receiver was appointed by the Bank of Ghana.

Asked to tell when the other team members of his team were appointed, the witness said, some were seconded on the same August 1, 2018, and others afterward.

Asked by defense counsel to confirm those who were seconded on August 1, Mr. Ayivor mentioned he does not have the full details of all the numbers that were seconded on August 1 because of the volume and the amount of work that was required to be done in that first day.

While recalling some of the names, he mentioned Sam Aluko, Robert Dzato, and Collins Agyapong as being part.

Asked to tell the court if he knew from which institutions those people he mentioned were seconded to the Receiver, the witness said “They were all employees of KPMG.”

Asked again if the receiver had anything to do with KPMG, the witness said, “The receiver was once a senior partner at KPMG.”

Interrogating the witness, the Counsel asked Mr. Ayivor if he was aware that on August 1, 2018, when he was seconded to the Receiver, the Bank of Ghana had written to the bank and given them time within which to regularise some issues the BoG had identified with the bank.

In his response, the witness said he was unaware.

When Counsel asked him to tell the court who pays for him and his services rendered to the Receiver, he said “I am an employee of KPMG so KPMG pays my salary.”

When the Counsel asked KPMG if it has paid any money for the services, he, the witness, render to the Receiver, KPMG disclosed that, “KPMG paid professional fees for the services of persons seconded from KPMG to perform on the receivership.”

Asked to tell the court if he knew the source of funds from which KPMG makes payment as a result of his services to the Receiver on secondment, Mr. Ayivor stated that the receiver’s fees are paid from proceeds realized from the receivership assignment in accordance with the requirements of the Banks and Specialised Deposit-Taking Institutions Act, 2016, Act 930.

“The Receiver’s interest and that of KPMG’s would be to execute the receivership work in accordance with the Receiver’s mandate as stipulated by the Act and also based on the directions that BoG will from time to time give the receiver in the course of his assignment.”

Mr. Julius Ayivor

The Financial and Economic division of the Accra High Court presided over by Justice Afia Serwah Asare-Botwe, a Justice of the Court of Appeal sitting as an additional High Court judge adjourned the case to February 10, 2023 for continuation.

Read Also : DDEP: GoG Provides Bondholders An Administrative Window To Complete The Process Of Tendering Their Bonds