Ranking member of parliament’s mines and energy committee, John Abdulai Jinapor, has revealed that he has consistently maintained that the Gas Sales Agreement (GSA) is not fairly priced and will result in significant losses to the state.

According to him, his attention has been drawn to a report on some social media platforms allegedly signed by the chairman of the committee on Mines and Energy, Samuel Atta-Akyea, on the Gas Sales Agreement (GSA) between Genser Energy and GNPC.

For the avoidance of doubt, Mr Jinapor categorically disassociated himself from the content and intents of the said report as it does not accurately reflect his position and that of the minority in its entirety.

“Firstly, it is true that I have consistently maintained that the GSA is not fairly priced and will result in significant losses to the state. It cannot therefore be the case that I disagreed with the position of ACEP/Imani that the GSA in its current form will result in huge losses to the state.”

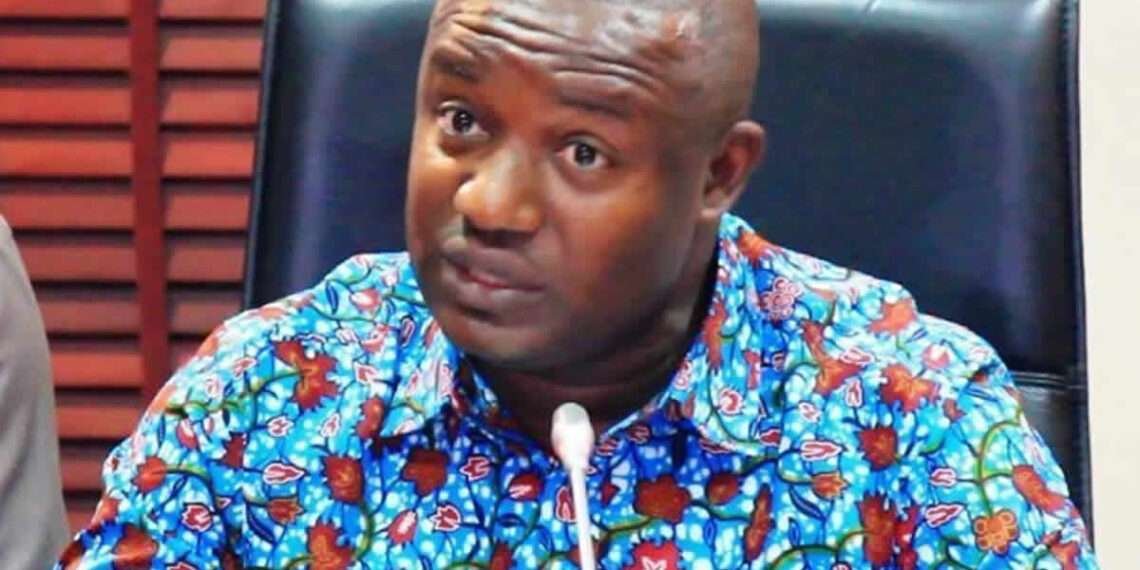

John Abdulai Jinapor

Report between Genser Energy and GNPC inaccurate

More importantly, Mr Jinapor maintained that it is inaccurate to report that the entire membership of the committee disagreed with his position. He explained that the said report contains factual inaccuracies and assumptions that do not address the key issues of value for money.

“From the evidence, the current Genser/GNPC gas price of US$2.790/mmBTU is far lower than the actual commodity price of US$4.879/mmBTU as approved by the PURC. The critical question the report fails to address is which entity will eventually pay for the price differential of about US$2mmBTU, which runs into billions of cedis over the contract tenure?”

John Abdulai Jinapor

In light of this, the ranking member on parliament’s mines and energy committee expressed hope that the referral by the Speaker to the joint committees of the Finance/Mines and Energy will provide the opportunity to address the critical issues as noted.

It will be recalled that a group of African think tanks and Civil Society Organizations (CSOs) called for the suspension of the Tema LNG project.

In a statement, the group convened by the Africa Centre for Energy Policy (ACEP) and the IMANI Center for Policy & Education (IMANI) stated that the deal was botched and could cost a $1.5 billion loss to Ghana.

They also called for the public release of all contracts and related agreements entered into by Ghana National Petroleum Corporation in relation to the Tema LNG project, as well as a halt to further funding and financing for the project.

Giving background to these calls, the CSOs held deliberations on the virtual sidelines of COP 27 on 9th November 2022 and launched case studies intending to show how corruption, mismanagement and onerous off-take terms, have hampered the strategic flexibility of African governments.

The first brief looked at the Tema LNG Terminal (Tema LNG), which is a project led by Helios Investment Partners to import LNG into Ghana.

It noted that Tema LNG poses a major risk to the already strained finances of GNPC, and that calculations by ACEP and IMANI suggest GNPC could be paying between $790 million – $1.357 billion a year, based on average 2022 Brent crude prices for gas the country doesn’t need.

Furthermore, it noted that the Tema LNG project was marred by “perverse bid-rigging and attendant procurement irregularities have heightened the corruption risk associated with the project”. The group equally lamented that these “costly investments” in oil and gas have been backed by the international community.

It expressed that development finance institutions have spent at least US$2.8bn in direct project finance to support the development of upstream and downstream fossil fuel projects in Ghana since 2010, and that Ghana’s vast renewable energy potential has generally been overlooked.

READ ALSO: Government Has No Excuse For Plunging Us Into Debt Distress- Finance Expert