The Governor of the Bank of Ghana (BoG) has revealed the measures the Bank has implemented to enforce its supervisory rules on financial institutions to ensure that a cleanup of the banking sector does not repeat.

According to Dr. Ernest Addison, BoG has revamped its structures and procedures for licensing with more thorough due diligence, implementing capital verification processes as well as making new rules aiming at transparency in policy development.

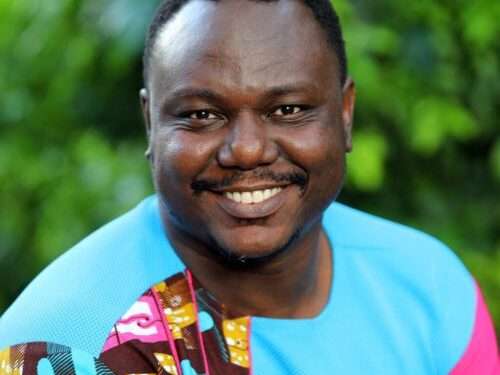

Speaking at the 2020 GIMPA Law School webinar Conference on the theme ‘Banking and Financial Sector Crisis in Ghana: Towards Sustainable Reforms’, Dr. Addison disclosed that his outfit has invested in a new state-of the art surveillance software which will enhance supervision of financial institutions to prevent a reoccurrence of BoG being in the dark of their activities.

“This new electronic surveillance system will help capture supervisory data from regulated institutions more accurately and prevent the high incidence of misreporting witnessed with the failed institutions. In addition, the software will enhance the analytical capacity of the supervision teams and help with more effective reporting of supervisory concerns for appropriate and timely interventions.”

With supervision as one of the major challenges to be addressed in the new banking sector, Dr. Addison stressed that the Bank has increased resources to its Departments that regulate and supervise the financial sector.

“It has augmented the staff strength of the Banking Supervision, Other Financial Institutions Supervision, and Financial Stability Departments to enhance their capacity, drawing on existing skills within the Bank of Ghana as well as from the private sector.”

He went on to say that BoG has also invested in training the staff that will be in charge of supervising the financial sector so as to promote higher standards of professionalism and ensure that the collapse of some financial institutions does not reoccur.

“In addition, the Bank has redesigned training programs for supervisory staff to enhance the quality of policy development, examinations, and reporting on regulated institutions. The bank is providing critical training and technical assistance to retool its supervisory staff to promote higher standards of professionalism and ethical behaviour with the objective to ensure supervision teams are better equipped to identify early warning signs, enforce regulatory requirements, and ensure prompt corrective actions to moderate the risk of failure in the financial sector.”

The Governor further assured that the measures put in place to enhance supervision of financial institutions have helped manage threats to stability of banks.

“The supervision of banks has been strengthened with systems and structures to identify, assess, and proactively mitigate or manage vulnerabilities and threats to stability.”

According to him, these measures have addressed challenges of the financial sector and there’s no cause of alarm for a reoccurrence of misreporting by financial institutions to the Bank.

“The Bank of Ghana has addressed the growing complexities and interconnectedness among various segments of the financial sector especially among banks and SDIs and the potential systemic risks that could arise due to regulatory arbitrage and information asymmetry.”