The government is set to commence negotiations with Eurobond holders and commercial creditors on Monday, January 22, 2024, in London.

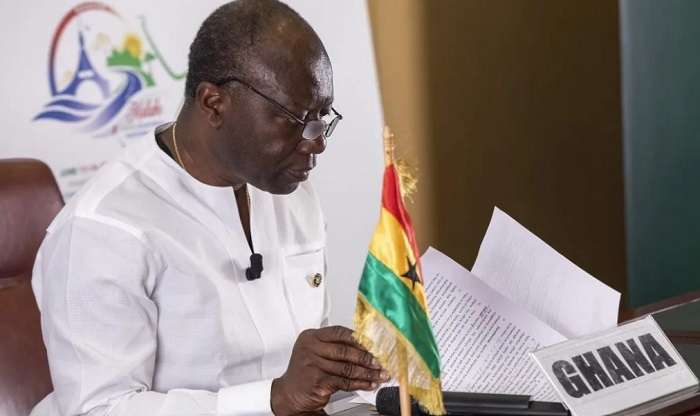

This strategic effort aims to persuade investors to accept the terms proposed by Finance Minister Ken Ofori-Atta in 2023.

Finance Minister Ofori-Atta expressed optimism about the upcoming negotiations, stating, “We have had discussions with the Eurobond investors and large creditors, and there is some goodwill.” This indicates a positive dialogue between the government and key financial stakeholders”.

Ofori-Atta emphasized the importance of negotiating in good faith, with the overarching goal of fostering an agreement that facilitates the country’s swift recovery.

Finance Minister Ofori-Atta expressed optimism about the upcoming negotiations, stating, “We have had discussions with the Eurobond investors and large creditors, and there is some goodwill.”

This indicates a positive dialogue between the government and key financial stakeholders. Ofori-Atta emphasized the importance of negotiating in good faith, with the overarching goal of fostering an agreement that facilitates the country’s swift recovery.

The Finance Minister’s eagerness to expedite the negotiation process is evident in his statement, “I am expecting that we negotiate in good faith to ensure the country comes back quicker than later.” This underlines the urgency and commitment of the government to resolve financial matters efficiently and effectively.

Building on recent successes, Minister Ofori-Atta is seeking to capitalize on the momentum generated by a recent deal with bilateral creditors. This deal successfully restructured a substantial $5.3 billion last week, demonstrating the government’s ability to navigate complex financial challenges and secure agreements beneficial to all parties involved.

As the negotiations unfold in London, the international financial community will be closely monitoring the proceedings. The outcome of these discussions holds significant implications not only for the economic stability of the nation but also for its standing in the global financial landscape.

The government’s ability to strike a favorable deal will play a crucial role in shaping investor confidence and determining the trajectory of the country’s fiscal recovery.

Background

At an initial engagement in London with the Eurobond holders and commercial creditors on October 16, 2023, the Finance Minister announced up to 40.00% cut of principal and interest rates on Eurobond holders.

He said this Is part of a broader strategy to “Close the Page” in reaching an agreement with all the actors in restructuring Ghana’s external debt.

Challenges Ahead

Concerns have been about the negotiation with the Eurobond holders unlike the Domestic Debt Exchange Programme and deal with the bilateral creditors.

However, the Finance Minister believes that a lot of work has been done over the past months to convince the Eurobond investors to accept the government’s offer.

He Is hopeful negotiations with the bilateral creditors and the Eurobond holders will be finalised by the end of March 2024.

“I was initially hoping to finalise the negotiations with all these creditors in December 2023, but looking at the way things are going now, the end of the first quarter is feasible”, the Minister added.

Some analysts have argued that finalising these negotiations may be critical in helping Ghana pass the second review under the International Monetary Fund (IMF) programme.

The Initiation of negotiations with Eurobond holders and commercial creditors marks a pivotal moment for the government. With the Finance Minister’s optimistic outlook and recent successes in restructuring deals, there is hope that the upcoming talks will pave the way for a strengthened economic future for the nation.

The eyes of the international financial community will be keenly focused on the outcomes emerging from these crucial negotiations in London.

READ ALSO: North Tongu MP Calls For Overhaul Of Accra Land Redevelopment Policy