The crisis experienced within the banking and financial sector in the country as a result of liquidity constraints of market intermediaries and deterioration of asset quality among others has been identified by the Securities and Exchange Commission.

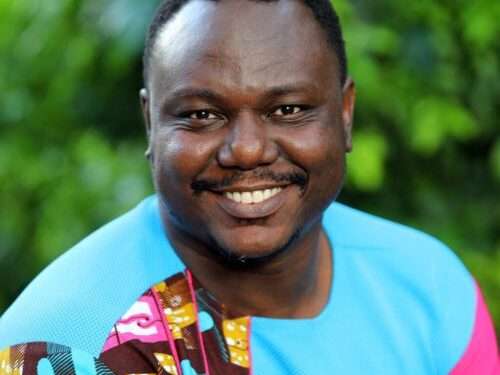

Rev. Daniel Ogbarmey Tetteh, highlighted some measures his outfit has so far carried out and intends to implement in an effort to mitigate and ensure reforms are sustained.

Discussions were under five broad categories namely structural issues, conduct issues, governance issues, financial literacy issues and regulatory issues.

“The establishment of the financial stability council, bringing together the regulators in the financial sector under the chairmanship of the Governor, is a step which I believe will help to resolve these structural issues.

“The cardinal maxim of our industry, which is my word is my bond, appears to have been flanked out of the window. Mis-selling, unethical behavior, including diversion of client’s funds, dishonesty including directing client’s funds to related parties without disclosure and unprofessionalism, including lack of adequate disclosure”.

Rev Ogbarmey Tetteh

Additionally, asset liability mismatch, lack of due care and diligence were some touted misconduct issues which fuelled the crisis incurred by some financial institutions.

“Our response is to prepare investment guidelines and conduct of business guidelines to be issued to the market in the coming weeks. We also intend to urge Ghana Securities Industry Association require standard ethical behavior of their members, especially as we work towards giving them recognition as a self-regulatory organization”.

Governance issues within the financial sector, Rev Tetteh revealed were borne out of the composition of boards which were done on considerations other than competence and values being brought to the table.

He indicated that effectiveness of boards were compromised due to infrequent meetings and failure to set up board committees as part of the governance handicap, with risk management being nonexistent and/or weak.

The Director General of the Securities and Exchange said his outfit “picked up the signs of the looming crisis in the asset management industry from onsite inspections”, as there has been mixed impact of the pandemic on the Commission.

“While volume and value of trading on the Ghana Stocks Exchange has been good within this period that of the Ghana Commodities Exchange has been adversely affected. In the case of assets under management, there seem to be a balance between withdrawals and news investments”.

Similarly, he buttressed on the relevance of incorporating ICT within the various aspect of licensees operation.

“What is clear is the need for investment in ICT driven service delivery platforms. As someone has said, the new normal means that work is no longer a place you go but what you do. We expect our licensees to invest more in ICT and also take note of the potential threat of cyber risk. We expect our licensees to rely on ICT to ensure adequate disclosure and engagements with the investing public”.

He made these revelations at the 2020 GIMPA Law School Webinar Conference