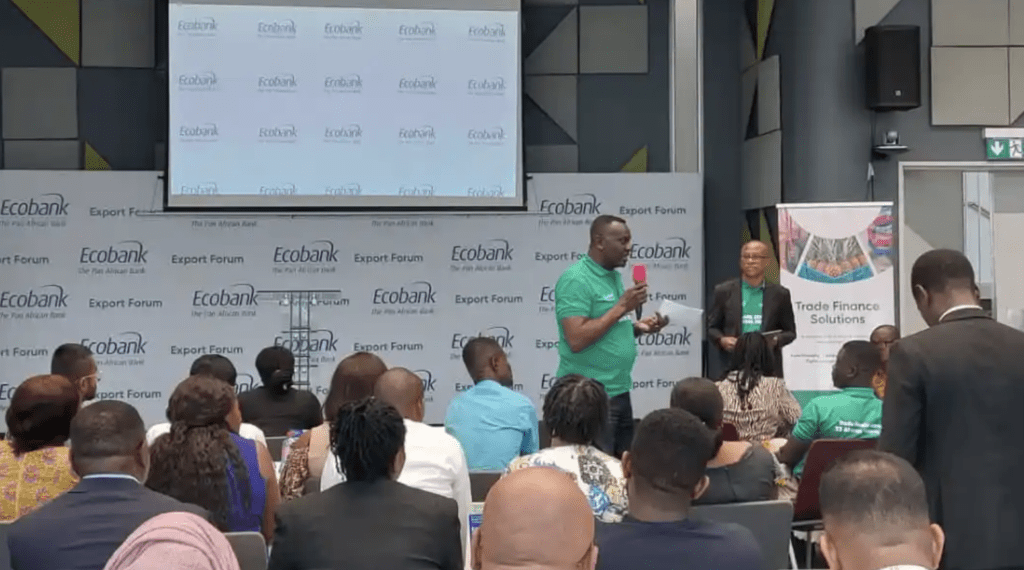

Ecobank Ghana has successfully organized a nationwide Agent Forum for its network of banking agents, known as Ecobank Agents.

These forums, held across key locations in Ghana, served as crucial platforms for agents to engage, exchange best practices, and discuss industry trends. The initiative aligns with the bank’s broader commitment to enhancing service delivery and advancing financial inclusion.

The Ecobank Agent Forum forms part of the bank’s continuous efforts to empower its agents with the requisite knowledge and tools to provide seamless banking experiences. The Ecobank Agency Banking model enables customers to perform basic banking transactions through accredited agents at retail outlets, significantly expanding financial services to underserved communities.

The forum provided participants with the opportunity to engage in insightful panel discussions and interactive workshops covering essential topics such as anti-money laundering and counter-financing of terrorism (AML/CFT), emerging market trends, and strategies for strengthening personalized client relationships. These discussions equipped agents with practical solutions to navigate regulatory processes and leverage digital transformation for business growth.

Additionally, the forum served as a vibrant networking platform, enabling agents to connect with industry experts, peers, and key stakeholders. Through these engagements, participants gained valuable insights and explored new business growth and expansion opportunities.

Commitment to Financial Inclusion

Speaking at the main forum in Accra, Mr. Tara Squire, Head of Consumer Banking at Ecobank Ghana, commended the agents for their pivotal role in extending the bank’s services to communities with limited access to traditional banking. He encouraged them to adopt innovative practices and leverage Ecobank’s ongoing digitalization efforts to enhance customer experience and operational efficiency.

“Ecobank remains committed to fostering financial inclusion across Ghana. Our agents play a critical role in bridging the financial gap, and we are dedicated to providing continuous training and capacity-building initiatives to support their work.”

Mr. Tara Squire

As part of the event, Ecobank Ghana honored select agents at the Ecobank Agent Excellence Awards. These awards celebrated high-performing agents for their exceptional service delivery, leadership, and innovation. The recognition aims to motivate agents to maintain high standards while expanding their service reach within local communities.

Ecobank Ghana has been at the forefront of digital and agency banking innovations, ensuring that financial services are accessible to all, regardless of geographical location. Through its Agency Banking network, the bank has significantly expanded its footprint, offering banking services in remote and semi-urban areas where traditional banking infrastructure is limited.

With 67 branches, 248 ATMs, and an impressive 3,906 Xpress Point agents nationwide, Ecobank Ghana continues to cater to diverse customer segments, including individuals, SMEs, educational institutions, churches, NGOs, multinational corporations, and government agencies. This extensive network underscores the bank’s commitment to providing inclusive financial solutions to drive economic growth and empowerment.

A Legacy of Financial Excellence

Ecobank Ghana, a subsidiary of Ecobank Transnational Incorporated (ETI), was established in 1989 and commenced operations in 1990.

The bank is licensed and supervised by the Bank of Ghana, with its headquarters located in Accra. ETI, the parent company, is a pan-African financial conglomerate headquartered in Lomé, Togo, operating in 35 countries across sub-Saharan Africa.

With a 68.93% ownership stake in Ecobank Ghana, ETI continues to drive the bank’s strategic direction, leveraging its extensive regional expertise to foster sustainable financial inclusion initiatives. The bank remains focused on strengthening its agency banking model, ensuring accessible, convenient, and secure financial services for all Ghanaians.

Ecobank Ghana aims to reinforce its commitment to agents through continuous training, networking events, and technology-driven solutions. By integrating advanced digital banking tools, the bank seeks to enhance agent operations, improve transaction security, and create a more inclusive financial ecosystem.

Ecobank Ghana’s Agent Forum underscores the bank’s dedication to bridging the financial gap and creating economic opportunities through agency banking. With ongoing innovations and strategic investments in financial inclusion, the bank is poised to shape the future of banking in Ghana, ensuring that financial services reach every corner of the nation.

READ ALSO: GSE Closes Higher as Republic Bank Leads Gainers with 10% Surge